the Creative Commons Attribution 4.0 License.

the Creative Commons Attribution 4.0 License.

Global value chains for digital automotive products: the integration of navigation systems into Chinese cars in Europe

Alexandra Stefanov

Julian Schwabe

With the automotive industry shifting towards connectivity and data-driven business models, Chinese electric vehicle (EV) manufacturers are emerging as competitors to European brands, driving the development of new value chains across various automotive sub-sectors. Amid these transformations, the article at hand explores the organization and spatiality of value creation for vehicle navigation systems from the perspective of new-generation Chinese EV manufacturers (BYD, NIO, XPeng, and Aiways) expanding into European markets. Drawing on 43 interviews and grounded in global value chain (GVC) and global production network (GPN) theory, the study analyses company strategy, localization, inter-firm relationships, regulations, and power structures in digital GPNs. The findings reveal how value creation is organized in digital automotive GPNs and, more specifically, how regulatory frameworks and the growing significance of data render Chinese automakers reliant on European and US service providers when operating in Europe.

- Article

(1036 KB) - Full-text XML

- BibTeX

- EndNote

In recent years, the digitization of vehicles has significantly contributed to a paradigm shift from “car-centric” to “user-centric” automobiles (Corwin et al., 2016). While in the past, the value of the car was created by the hardware, the construction quality, and the driving experience, nowadays cars have to fulfil requirements such as connectivity, convenience, and user experience (Dyer et al., 2022; Euromonitor International, 2016). Thus, the availability of digital on-board functions becomes a key differentiator for modern cars and paves the way for new business models (Gerster, 2022), with automotive companies becoming as engaged in generating and enhancing data as they are in manufacturing vehicles (Zook and Grote, 2025). Especially Chinese auto manufacturers are establishing durable relationships with customers by controlling and elevating the user experience (Burgard, 2022; Friedel, 2022; Yang et al., 2023) while continuously updating the in-car software and creating new revenue streams such as subscription models, on-demand services, in-car purchases, and over-the-air upgrades (Yang et al., 2023).

Data generation and data mining hence lead to “data-driven decision making” (Sturgeon, 2021) and to intense rivalry among new players vying for strategic positions within the value chain (Boes and Ziegler, 2021; Butollo et al., 2022; Helbig et al., 2017; Perkins and Murmann, 2018). According to global management consulting firm McKinsey, by 2030, data-driven services have the potential to generate an additional USD 1.5 trillion in revenue for automotive OEMs (original equipment manufacturers) (Gao et al., 2016). In this context, vehicle navigation systems are a relatively established digital product which have grown in sophistication over the past decades (Choi et al., 2016; Harris, 2023; Infopulse, 2022) and have developed into a gateway for the collection of data that can be utilized for refining digital functions and products in the context of the navigation system or elsewhere (Yang et al., 2023; Hagenmaier et al., 2023; Hattula et al., 2023). The global market for automotive navigation systems in the years 2024–2025 was estimated to range between USD 26.4 and 39.3 billion, with an expected compound annual growth rate (CAGR) spanning between 4.4 % and 7.7 % by 2030, depending on the source consulted (Industry Research, 2024; Mordor Intelligence, 2025; Research and Markets, 2025). This indicates that there will be increased importance of automotive navigation systems over the next years.

Besides technological transformation, the automotive industry is undergoing fundamental changes with regard to the geographical distribution of leading manufacturers. Headlines such as “Vehicles from Chinese companies, everywhere” (Hägler, 2023) and “The car of the future comes largely from China” (dpa, 2023) surrounding Auto Shanghai 2023 (the Shanghai International Automobile Industry Exhibition) illustrate how Chinese automakers challenge European (and especially German) car brands and set standards in this new era of electric and software-defined automobiles (Burgard, 2022; Friedel, 2022; Yang et al., 2023). According to the European Automobile Manufacturers' Association (ACEA), in 2022 Chinese brands made up nearly 4 % of the total electric car sales in the EU, a substantial increase from the 0.4 % share they held just 3 years before (ACEA, 2023). Within this context, the study at hand focuses on the organization of value chains for digital products, particularly regarding navigation systems, drawing mainly from the conceptual literature in the strongly intertwined discussions of global value chains (GVCs; Gereffi et al., 2005) and global production networks (GPNs; Henderson et al., 2002; Ponte and Sturgeon, 2014; Coe and Yeung, 2015), as well as from new literature streams centred on digital value chains. As argued by Butollo et al. (2022), with the emergence of digital technologies, the GVC and GPN frameworks require a “technological upgrading” (Butollo et al., 2022), since the existing theories recognize the part played by technology in geographically fragmented production but do not usually delve into the impact of technological advancements on inter-firm relations (Butollo et al., 2022).

To date, when examining the implications of digitization for the organization of value creation, the academic discourse has emphasized the decreasing restraint of physical spaces, while it has placed a significant focus on the digital platform economy (e.g. Grabher and Van Tuijl, 2020; Kano et al., 2020; Stallkamp and Schotter, 2018; Verfürth and Helwing-Hentschel, 2024), the sharing economy (e.g. Attoh et al., 2019; Braun et al., 2016; Ferreri and Sanyal, 2018), the realm of labour, and the future of work (e.g. Briken et al., 2017; Howson et al., 2022; Woodcock and Graham, 2019). Yet, there has been limited exploration of the core principles governing the value creation for digital products like the in-car navigation system. Moreover, as analysed by Zook and Grote (2025), the interplay between state regulations and firm strategies for leveraging digital technologies across various geographic regions remains underexplored.

In order to address these research gaps and examine how Chinese car manufacturers organize value creation for navigation systems when expanding into Europe, this paper employs an explorative approach comprised of semi-structured expert interviews with representatives of Chinese and international automotive OEMs, consulting firms, industry associations, and official organizations. In total, 43 interviews were conducted, out of which 24 were 30 to 60 min long in-depth inquiries, while another 19 were shorter conversations of about 20 min covering specific, individual questions. The data collected in the interviews are complemented by information available in the grey literature, e.g. reports from consultancies, policy documents, media reports, and company press releases, as well as by input from industry events and trade fairs.

We base our current analysis on the case studies of the Chinese electric vehicle (EV) OEMs BYD, NIO, XPeng, and Aiways, which have been active in the European market since 2021. While the four new-generation car makers benefit from governmental support in China through subsidies, favourable policies, and initiatives in line with national strategic priorities, they all remain independently managed and are not classified as state-owned enterprises (Ezell, 2024; Tian et al., 2024; Yang, 2023).

Within this study we conceptually aim to make contributions in three areas.

First, we take the governance patterns in GVCs proposed by Gereffi et al. (2005) and the firm-specific strategies within GPNs developed by Coe and Yeung (2015) as a starting point to present the type of supplier–buyer relationships observed between lead firms (in our case the Chinese OEMs) and specialized suppliers (the navigation service providers), with a focus on the way in which technological advancements and the companies' strategies impact inter-firm relationships (Butollo et al., 2022).

Second, we explore how Chinese electric vehicle OEMs set up their value creation strategies, while showing the impact of digitization on established GPN structures and inter-firm relationships. Considering the attributes of digital inputs and the oftentimes modular nature of the digital economy (Sturgeon, 2021), we further explore the strategic positioning of firms to maximize value capture at different stages of the value chain.

Third, we examine how the state as a regulator (Horner, 2017), along with institutional extra-firm actors (e.g. government and industry organizations) and the instruments they employ (e.g. standards and regulations), is impacting the spatial fragmentation of value creation in digital GPNs. These dynamics are reshaping interdependencies within the ecosystem (Lechowski and Krzywdzinski, 2022) and leading to both geographically fragmented and spatially anchored digital products.

In the context of the GPN/GVC discussion and our case studies, our goal is to address the following three research questions:

-

How do the emergence of digital products and their spatial (non-)transferability reconfigure inter-firm relationships and power dynamics within automotive GPNs?

-

How do regulatory frameworks and policies in the EU shape the spatial organization of digital value chains for Chinese automotive OEMs expanding to Europe, and to what extent do these constraints reinforce dependencies on European and US service providers?

-

How do digital input providers position themselves strategically to maximize value capture?

Drawing on insights from interview-based case studies, in the following sections we will analyse the paradigm shifts occurring in automotive production networks and the increasing importance of in-car navigation systems. This is followed by an overview and a discussion of the organization and spatiality of value creation for vehicle navigation systems from the perspective of OEMs.

The theoretical framework of this study is based on the closely intertwined concepts of GVC and GPN as they are employed in various strands of the literature (Agostino et al., 2015; Pavlínek and Ženka, 2016; Schwabe, 2020a; Foster, 2023). With both originating from the concept of global commodity chains (GCCs) and belonging to the same family of frameworks, they offer related approaches to characterize various types of inter-firm relationships (Barnes and Sheppard, 2024). Within this context of the GPN and GVC discussion, we examine the organization and spatiality of value creation for vehicle navigation systems from the perspective of OEM lead firms and their structuring factors such as regulatory frameworks, physical infrastructure, and strategic orientation. We start with a characterization of the inter-firm relationships of lead firms and suppliers using frameworks outlined by Gereffi et al. (2005) and further advanced by Coe and Yeung (2015). Both Gereffi et al. (2005) and Coe and Yeung (2015) have defined inter-firm relationships using very similar characterizations. In this study, we base our conceptualization of inter-firm relationships on the value chain governance types outlined by Gereffi et al. (2005), as they refer more explicitly to the characteristics of the value creation input at hand, rather than independent, capitalist dynamics, as the main causal factors explaining different types of supplier–buyer relationships. We further use the concept of extra-firm actors outlined by Coe and Yeung (2015) and recent GPN literature on the characteristics of digital products to analyse the structuring factors, in particular state regulations, which shape value chain governance and spatial allocations for creating vehicle navigation systems. We employ the recent literature on digitization in the GPN/GVC discussion (such as Foster, 2023) to base our framing of “value” in this study.

Regarding the organizational dimension of inter-firm relationships, Gereffi et al. (2005) categorize governance patterns based on the following features: the complexity of information transfer required for a transaction in a global value chain, the degree to which information may be codified and effectively communicated between the parties involved in the transaction, and the capability of suppliers in respect to the transaction's requirements. In their framework they identify five types of global value chain governance (market, modular, relational, captive, and hierarchy) with specific characteristics and with lead firms having varying degrees of direct control over manufacturing processes in each type of governance (Gereffi et al., 2005). Within this study we argue that the governance patterns in the example of the digital in-car navigation systems of Chinese OEMs expanding to Europe fulfil the criteria that Gereffi et al. (2005) characterize as “modular”: complex technical inputs which are easy to codify and transfer between lead firms and suppliers, a relatively low degree of explicit coordination and power asymmetry, and low costs when switching to new partners (Gereffi et al., 2005).

To examine intra-firm relationships, we use Coe and Yeung's (2015) concept of intra-firm coordination (the consolidation and internalization of value activity within the lead firm, the strategic partner, and/or the specialized supplier) to show how most of the OEMs investigated are developing their navigation software in-house, in an attempt to maximize value capture. Firms in high-risk environments with low financial pressure, as well as high proprietary capabilities and low cost capability ratios, are most prone to deploying the strategy of intra-firm coordination, as they tend to internalize critical technological resources and only outsource parts of production to highly specialized external suppliers (Coe and Yeung, 2015).

Besides the conceptual frameworks of Gereffi et al. (2005) and Coe and Yeung (2015), we base our analysis of the inter-firm relationships between Chinese OEMs and their navigation providers on the concept of the modularity of value chains presented by Sturgeon (2021). As the digital economy's foundational technologies become increasingly complex, no single organization can fully grasp or control them. Consequently, the characteristics of “digital” products (e.g. intangible, spatially transferable without loss of time and costs) affect the spatiality of their production, e.g. in the form of offshoring and outsourcing, a trend enabled by value chain modularity and facilitated by supplier switching (Sturgeon, 2021). As data become a production factor, access to data, data collection, and data mining enable new profit-generating business models as well as “data-driven decision making” (Sturgeon, 2021). Within this context, data can be viewed as an asset, as value sought after by companies within a GPN (Zook and Grote, 2025). Particularly the control of key technologies and data, as explored by Lechowski and Krzywdzinski (2022), is a significant source of power for which GPN actors compete, since the data collected can pave the way for the creation of new products and entry into new markets and industries (Loonam and O'Regan, 2022; Van Alstyne and Parker, 2017; Pavlínek and Ženka, 2016; Schwabe, 2020a). In GPNs, firms leverage their available resources to maximize value capture, including profits, know-how, market access, or, in the case of the digital economy, data (Coe and Yeung, 2015; Pavlínek and Ženka, 2016; Schwabe, 2020a), while competition for value capture is a major factor in the formation of relationships between actors (e.g. firms, government entities, non-governmental organizations).

The concept of “value” in GPNs has evolved over time, leading to overlapping and sometimes conflicting definitions (Coe and Yeung, 2015; Foster, 2023), yet so far limited attention has been given to defining value in GPNs with digital value chains. While Gereffi et al. (2005) focus on value as “value added” appropriated through governance by lead firms, Coe and Yeung (2015) broaden the concept to include various forms of economic rent, emphasizing value creation, enhancement, and capture across firms, regions, and institutions within GPNs. However, conventional GVC and GPN frameworks struggle to account for digital value chains, with the definition of value being under-theorized, ambiguous, and often implicit. A specific discussion about what constitutes value is lacking. Hence, Foster (2023) suggests re-centring the concept of value by considering factors like techno-economic rents, the monopolization of technical assets (e.g. data), and the growing influence of technology companies. By adopting the definition of value creation as “a process through which a residual economic surplus is generated by the transformation of materials and inputs into a new product” (Coe and Yeung 2015), the maximization of value capture can be viewed as a major firm-level motivation that determines the companies' strategic positioning. In the context of the study at hand, this refers to the search for exclusive access to know-how and data, as will be elaborated in the following sections.

While the value chains for digital products tend to be modular in nature, as described by Sturgeon (2021), the geographic location where the digital input is created is assumed to be mostly irrelevant. Nevertheless, depending on the type of input needed, it can be contingent upon regulations and physical infrastructures, thus becoming spatially anchored. With respect to this, data can be seen as a strategic, geographically grounded source of competitive advantage that are integrated into production processes to generate profit, steer innovation, and create new mechanisms of value creation and capture (Zook and Grote, 2025).

As such, GPN governance is shaped by lead firms; by extra-firm actors such as governmental and non-governmental organizations, institutions, policymakers, and consumers; and by external factors such as regulations and standards (Coe and Yeung, 2015; Henderson et al., 2002; Ponte and Sturgeon, 2014). There has been some criticism of state actors being underrepresented within the GPN framework (Yeung, 2018; Neilson et al., 2018), while it is clear that state actors on all levels strongly shape the spatial and organizational configuration of GPNs (Dicken, 2015; Smith, 2015). Against the background of the state as a regulator that employs policy tools to shape development outcomes, protect domestic interests, and respond to new challenges, thus limiting and restricting the activities of firms within GPNs (Horner, 2017), in this paper we consider external factors such as regulations and standards to be instruments of institutional extra-firm actors (e.g. EU regulatory bodies, road authorities, mapping agencies), as conceptualized by Coe and Yeung (2015). While international standards can be a major obstacle to firms joining new GPNs, they play an important role in promoting technological advances within the industry and impact corporate value creation strategies (Coe and Yeung, 2015).

Building on this conceptual background, the article at hand analyses the Chinese OEMs' value creation strategies when providing navigation system services in European markets and explains the organization and spatiality of value creation. For this aim we are employing the conceptual frameworks of Gereffi et al. (2005) and Coe and Yeung (2015) to analyse how inter-firm relationships and power dynamics within automotive GPNs are being reshaped by digital products and how EU regulations influence the spatial organization of digital value chains. Furthermore, based on Lechowski and Krzywdzinski (2022) and Foster (2023), we assess how value can be defined in automotive GPNs in regard to digital products. In order to better understand these developments, in the following section we will explore the characteristics of traditional automotive value chains, the value-added inputs of navigation systems, the role of regulations, and the main navigation system providers in Europe and China.

4.1 Traditional automotive value chains and the Chinese car industry

In the past, throughout the decades when combustion engines had reached technological maturity, automotive GPNs were defined by severe OEM competition and overcapacities, and the actors involved were under significant pressure to improve the cost capability ratio (Dicken, 2015). According to Sturgeon and Van Biesebroeck (2011), cost reductions, incremental innovations, and new market expansions were the main ways in which competitive advantages were obtained. These developments created a highly hierarchical system comprised of dominant lead firms and tier 1 suppliers of sub-systems, along with component and parts suppliers that became exceedingly dependent, with weak bargaining power, low profit margins, and limited product diversity (Pavlínek, 2018; Schwabe, 2020a; Yeung, 2023).

Over the course of the 20th and early 21st centuries, driven by major automotive manufacturers aspiring to provide a diverse range of vehicle models to increasingly globalized markets in a cost-efficient way, the automotive industry grew into intricate, globally integrated, and geographically grouped industrial systems (Sturgeon et al., 2008; Dicken, 2015; Sturgeon and Van Biesenbroeck, 2011), while today, the spatio-organizational characteristics of automotive GPNs are undergoing significant transformation and reconfiguration. Among the current shift away from combustion engine technology and towards the industrial trends of digitization and electrification (Yeung, 2023), industrial value chains centred on combustion engine development and manufacturing run the risk of becoming obsolete as battery-based electric engines progressively become the primary propulsion technology (Schwabe, 2020a). In addition, new core competencies like software and AI development are becoming visible through the growing significance of on-board digital functions, autonomous driving, and connected vehicles (Teece, 2018).

Regarding the Chinese automotive industry, up until the 2000s, the sector's growth was dominated by state-owned companies and relied heavily on joint ventures (JVs) with foreign car makers. As foreign partners controlled what technology was transferred and withheld advanced know-how, Chinese firms were able to improve the automotive production capacity but became dependent on the foreign partners and lacked opportunities to develop their own advanced technologies (Liu and Tylecote, 2009; Van Tuijl et al., 2016).

In the late 2000s and 2010s, the Chinese government pivoted to make EVs a strategic priority (Yang et al., 2023). Strong state intervention, including industrial policy and substantial funding, played a central role in shaping the industry (He and Jin, 2021; Yang et al., 2023). By leveraging the capital, technology, and management expertise brought in by foreign automakers, combined with policies favouring local firms, generous subsidies, tax exemptions, and research investments, within a decade China managed to create a highly competitive EV market (Thun, 2006; Van Tuijl et al., 2018; Yang et al., 2023). Now leading in batteries, EV tech, and global brands (not only state-owned, but also private ones), the industry is characterized by dynamic competition, rapid innovation, and a growing international footprint (Burgard, 2022; Friedel, 2022; He and Jin, 2021; Yang et al., 2023).

Against this background, based on the examples of privately owned Chinese OEMs expanding to Europe and the case of navigation systems, in the following sections we will explore how the automotive sector is nowadays shifting towards less hierarchical value chains with more balanced inter-firm power relationships.

4.2 Value-added inputs of navigation systems and the role of regulations

In order to gain a deeper understanding of the value-creating steps involved in navigation systems, it is essential to take a closer look at the intricate structure of components comprising an automotive navigation system, with the main elements being receivers, sensors, gyroscopes, and processors, as well as the software and the map database with real-time traffic information (Choi et al., 2016; Harris, 2023; Infopulse, 2022). This paper focuses on the map database and the software of the navigation system, as they constitute digital services with a creation that is rooted in localization and tangible assets, such as satellites and mapping vehicles. Thus, despite its inherent geographical disconnect, the digital product becomes spatially anchored and embedded in a specific geographic location, prompting Chinese OEMs to collaborate with local navigation service providers.

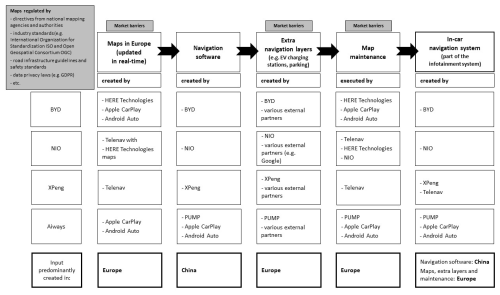

Figure 1The map creation process of the in-car navigation system. Own illustration based on online sources and interviews.

The map creation process for the in-car navigation encompasses a myriad of steps that have rapidly evolved in recent years due to technological advancements. In order to generate accurate maps which update in real time, navigation providers utilize data from multiple sources and process them with specialized software and algorithms (Dutka, 2023; Zavadko, 2023). Some of the most significant inputs and steps are depicted in Fig. 1. As can be observed in the simplified illustration of the navigation software value chain, during the creation and maintenance process, the maps used for navigation systems are regulated by a combination of directives from national and EU authorities concerned with ensuring the accuracy and consistency of mapping and geospatial data across member states. For instance, the maps must adhere to international industry standards like ISO/TR 19121 (OBP, 2000) or ISO 19133 (OBP, 2005). As each satellite establishes its own standard based on the unique features of its sensors, the integration of data is difficult and requires overarching standardization, such as the imagery and gridded data regulated within ISO/TR 19121. ISO 19133 further regulates data and services required to support tracking and navigation applications for mobile clients. In addition, road infrastructure guidelines and safety regulations are made available by the European Commission in order to provide EU member states with a set methodology for road safety assessments which are required under the Road Infrastructure Safety Management Directive (EUR-Lex, 2019). The assessments include features such as lane width, road curvature, design of junctions, and roadside layout and thus have a direct impact on street mapping and navigation systems (European Commission, 2023). A particularly important role is also played by data privacy laws such as the General Data Protection Regulation (GDPR) (EDPB, 2021; Wolford, 2023), which regulates the usage of personal data. Furthermore, on a national level, European countries have their own mapping agencies (Esri, 2011), as well as national, and sometimes regional or local, road authorities which operate within a framework of EU regulations but retain significant responsibility and autonomy for road management and rule enforcement (EU-ICIP, 2022). This adds another layer of complexity to the strategies followed by Chinese OEMs as they expand into the European market. As will be shown in the case studies below, the ramifications of the regulations make compliance challenging and limit the number of capable map providers in Europe. As soon as the maps are generated by the navigation provider, they are distributed to OEMs or other service providers that implement them into navigation software, developed either by the OEM or by its external partners.

Within the process presented in Fig. 1, the navigation software represents the main touchpoint with the customers. As such, its creation, as well as the decision to develop it either in-house or externally, is impacted not only by the company's strategy, but also by customer requirements and feedback. Thus, the navigation software plays a pivotal role in the user experience and in the perception that users have of the in-car navigation system and the overall car quality. While the map maintenance is equally important to keep the navigation accurate and up-to-date, it consists of more complex mechanisms, shaped by various inputs from institutions and authorities, as well as directives, regulations, and standards. In the following section the organization of navigation services will be outlined based on case studies of Chinese OEMs expanding to Europe.

4.3 Navigation system providers in Europe and China

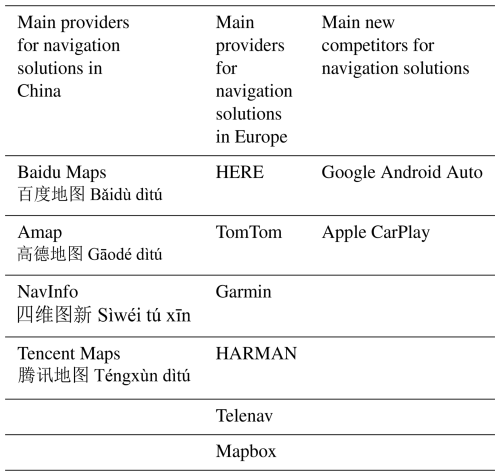

Upon examining the navigation software ecosystems in Europe and China, it becomes evident that these two regions rely on different main providers for navigation solutions, as shown in Table 1. Alongside the main actors, various service suppliers such as Google Android Auto and Apple CarPlay have emerged in recent years as competition within the automotive navigation realm. Unlike traditional stakeholders, technology companies such as these possess substantial in-house expertise in handling and harnessing vast volumes of data (Michaelsen et al., 2020) and they are seeking to cover a broad range of essential functions inherent to software-driven vehicles which go beyond the realm of navigation. This holds particular significance considering the growing importance of data usage and data sharing within the automotive sector (Michaelsen et al., 2020). Current dynamics suggest a shift towards more vertically integrated but horizontally fragmented value chain organizations of navigation systems. Interviews conducted for this study with automotive experts indicate that new market entrants tend to offer all-in-one navigation solutions, including maps, smart routing, charging stations, and on-street parking options. This differs from traditional providers that focus on single layers and rely on larger collaborative networks for integration. However, to date, no existing supplier can provide accurate global navigation maps, presenting a challenge for globally operating vehicle OEMs that need to find region-specific solutions. As a result, as an interviewed representative of an automotive navigation supplier explained, “it is common for car manufacturers and suppliers to enter into global partnerships to further develop their infotainment [and subsequently navigation] systems. These partnerships can improve access to technology, know-how, and markets and enable shared value creation.”

Table 1Main providers for navigation solutions in China and Europe. Own compilation based on 2265 Android Network (2023), Dirscherl (2023), and interviews.

Technological advancements and value chain modularity (Sturgeon, 2021) thus spark a power struggle within the industry, as OEMs and suppliers compete for value creation and value capture. Through shorter contracts (usually spanning 3 to 5 years as opposed to 10 to 15 years in the past) and over-the-air updates, OEMs have more flexibility in switching partners within the lifetime of a vehicle, pressuring suppliers into staying innovative and competitive. At the same time, the automotive sector is facing increasing competition from companies that were previously unrelated to the industry. OEMs find themselves in power struggles with new industry entrants like digital start-ups or digital economy companies outside of the automotive sector (e.g. Apple and Google) regarding control over the end-user interface and user experience, as all participants strive to secure direct access to the end customers and their data (Hoeft, 2021; Alvarez Léon and Aoyama, 2022).

Considering the previously mentioned developments, the question that arises is how the Chinese new-generation car makers (BYD, NIO, XPeng, and Aiways) that have been expanding to Europe since 2021 approach the topic of navigation systems and set up their value creation strategies as they venture into the European market. Because Chinese mapping partners like Baidu do not have the necessary data infrastructure and the corresponding mandatory licences for operating in Europe, the OEMs are required to rely on European and US suppliers that limit their own value creation. This section is mainly based on interview comments, complemented by publicly available information such as press releases and media reports.

As outlined by one interviewed expert, the selection of external partners in the realm of navigation is generally characterized by a dynamic nature, with the potential suppliers being evaluated based on criteria such as technological competence, experience and reputation, scalability and adaptability, up-to-dateness and accuracy of the maps, and local market knowledge. Each Chinese OEM, motivated by multiple factors examined in this paper, has a customized strategy of partnering with external providers for navigation systems. The strategies of BYD, NIO, XPeng, and Aiways are briefly outlined in the following:

5.1 BYD

BYD Auto, the largest one of the OEMs, was founded in 2003 and works together with Baidu Maps for their navigation system in China. However, an interviewee pointed out that BYD was unable to establish partnerships with Chinese map data providers during the European expansion phase due to concerns about compliance with European data protection regulations and unavailable licences for collecting and recording data within Europe:

In Germany, we thought a lot about it and we talked to various Chinese cooperation partners. [But] they are not able to film or record the data in Europe. Because they have this fear of the Data Protection Act or GDPR … We don't yet have any good partners from China for the European market. We plan to work with HERE [Technologies] in the next 5 years. (Interviewed representative of BYD)

Based on input from experts, it is crucial for Chinese OEMs to have a European partner due to the constant emergence of new regulations. For instance, in 2021, the European Union introduced the Intelligent Speed Assistance (ISA) regulation 2021/1958, outlining technical requirements for approving cars with intelligent speed assistance systems (EUR-Lex, 2021). During mandatory road tests, BYD observed that their Advanced Driver Assistance System (ADAS) could only identify European street and speed limit signs with an accuracy of 90 %. However, after integrating HERE Technologies, which has the European sign information stored as data points in a large database within its system, sign recognition improved significantly. Furthermore, not only do national regulations play an important role in various European countries, but also one of our interview partners from BYD observed that different countries implement EU regulations with various degrees of strictness: “We … noticed that in Spain the data protection law is not as strictly implemented as in Germany.” This adds further complexity to the strategies of Chinese OEMs when expanding to different European countries.

Currently, BYD utilizes in-house-built software developed in China and adapted to the European market for providing infotainment functions in their vehicles, integrated with mapping and navigation data from HERE Technologies. Additionally, BYD incorporates Android Auto and Apple CarPlay into their systems in response to customer preferences.

5.2 NIO

In contrast to BYD, NIO was only founded in 2014, with one of its main features being an explicit focus on customer experience, user centricity, and community building (Yang et al., 2023). In terms of navigation systems, various partnerships for navigation solutions can be observed in NIO's models within China: earlier models utilized the map providers NavInfo, Baidu Maps, or Amap, whereas more recent models exclusively rely on Amap (Zhang, 2022). The NIO navigation software is developed in China as global software which is later localized for different world regions in terms of user and application programming interfaces. For Europe, the core map data are sourced from Telenav, which offers routing services based on maps supplied to them by HERE Technologies. NIO consequently adds supplementary layers to these components, such as EV smart routing, which includes details like charging station locations, their availability, and current charging costs in real time. As an interview partner explained,

This means we take the maps from HERE, the charging stations from our charging station provider, the initial route from Telenav and then we ourselves have an algorithm that basically calculates the charging stops on this initial route … So, it's very multidimensional. (Interviewed representative of NIO)

Based on the insights gathered from the interviews, it appears that NIO does not have immediate plans to develop its own mapping solutions in the future. The reason for this lies in the fact that map creation is a complex undertaking that would demand a significant investment:

Building a complete map is such an investment, it's so much technology. I have to constantly buy satellite images, I have to develop the algorithms, convert the satellite images, I have to measure, etc. The cameras and sensors are only used for updating [the maps]. (Interviewed representative of NIO)

While NIO has a myriad of collaborations for navigation systems, their long-term goal is to minimize their dependence on external providers for the map maintenance and collect as many data as possible themselves. Therefore, in addition to partnering with forward-thinking firms such as HERE Technologies (HERE, 2023), before entering any new market, NIO sends out mapping vehicles equipped with high-precision GPS antennae, lidar (light detection and ranging) sensors, and mmWave (millimetre-wave) radars to scan and map the streets. According to the company, the necessary algorithms, localization systems, and control strategies are all created in-house (McDee, 2022).

Currently, NIO does not offer any integration with Apple CarPlay or Android Auto. As mentioned by the interview partners contacted for this paper, NIO's aspiration is to exclusively maintain its own in-built navigation system in order to avoid disruptions in the car's inherent infotainment configuration and to keep control over the user experience. Therefore, NIO's objective for the future is to improve their navigation services to the extent to which the users no longer desire alternatives, as an interviewed representative of NIO explained: “Our goal is to make the software so good that the user doesn't miss anything. It's the more difficult goal, but in the end it's the better experience overall.” Nonetheless, at present, NIO customers exhibit a high demand for Android Auto, Apple CarPlay, and Google Maps. As one user mentioned in the chat function of the German version of the NIO App: “I would prefer Android Auto or Apple Car Play. I never use the internal navigation systems because they are usually not as good. Smartphone integration via Android Auto is actually an argument for or against a vehicle for me” (NIO App, 16 April 2023). NIO seems to be listening to its users' feedback, as the company announced new strategic cooperation with Google, which is now providing location information with points of interest (POIs) for NIO cars in Germany (Lehle, 2023).

5.3 XPeng

With Xmart OS, the third OEM examined for this paper, XPeng, founded in 2014, also runs its own, in-house-developed operating, infotainment, and navigation system which does not support Apple CarPlay or Android Auto, an omission that has not impacted sales in China, as the company explains (Gibbs, 2023). However, online forums indicate that, similarly to NIO users, XPeng car owners and dealers in Europe are asking for the support and integration of Android Auto and Apple CarPlay.

While in China, XPeng is working with Amap's third-generation in-car navigation system for the development of autonomous driving, in Europe the partner of choice for the EV navigation is Telenav (Telenav, 2021). Similarly to the other interviewed OEMs, XPeng employs their proprietary self-developed system, which encompasses global basic software created in China into which the navigation component is integrated, with country-specific features added on top (Henßler, 2023).

5.4 Aiways

Aiways, founded in 2017, works together with Baidu Maps to develop their navigation system for the Chinese market, while in Europe, Aiways relies solely on third-party software like Apple CarPlay, Android Auto, and the app PUMP (Aiways, 2022), which is integrated with Google Maps and has the capability to access vehicle data in order to suggest charging stations according to the current battery capacity. This represents an interesting exception from the abovementioned use cases of OEMs that are trying to internalize as many value creation steps as possible. An OEM representative who was interviewed by us explained that Aiways decided to minimize expenses by choosing not to internally develop the navigation system or even the navigation software:

We want to concentrate on building cars. That's already hard enough. And then to compete at the same time with Google and Apple …, that doesn't make much sense. And it costs money to keep everything up to date … There is nothing better than what is already on your phone. (Interviewed representative of Aiways)

Bearing this in mind, Aiways immediately integrated Apple CarPlay and Android Auto. Rather than investing in licences for Google Maps, Aiways decided that, in the European context, the car owners' smartphones are the most up-to-date devices. This reasoning led to the conclusion that utilizing smartphone maps mirrored on a display in the car is sufficient for the navigation needs of their customers, as Aiways is first focusing on selling as many EVs as possible and establishing themselves as a player in the market.

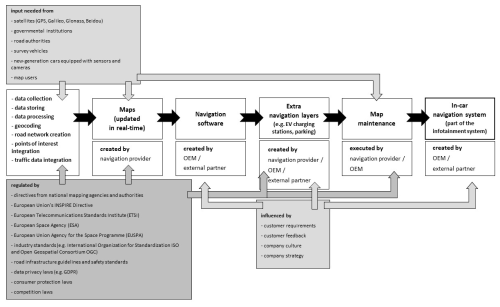

As can be observed in Fig. 2, within the map production process, Chinese OEMs are prompted by a combination of regulations, compliance, and required supplier expertise to localize various value-added inputs. This applies in particular to map creation, map maintenance, and the extra navigation layers which are not transferable across regions, as they are constrained by compliance uncertainties and lacking access to infrastructure and map material. As a result, these are almost exclusively outsourced to European (HERE Technologies, Telenav, PUMP) or US (Apple CarPlay, Android Auto) service providers that have the licences, expertise, and compliance knowledge required for operating in Europe. Meanwhile, the navigation software is transferable across distance and regulatory regimes with little adaptation and can predominantly be created in China (with the exception of Aiways, which made the conscious decision to rely only on external partners for the software as well). In the following section the conclusions from these case studies are discussed within the context of the theoretical framework.

Within the preceding sections of this paper, we addressed our initial research questions as follows.

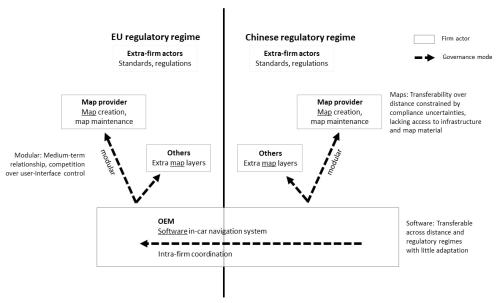

First, we examined the extent to which the emergence of digital products and their spatial (non-)transferability are reshaping inter-firm relationships and power dynamics within automotive GPNs. The results from our cases studies confirm the assumption that inter-firm relationships between Chinese OEMs expanding to Europe and their European and US navigation suppliers resemble a modular type of supplier–buyer relationship similar to the ones in traditional automotive value chains, as illustrated in Gereffi et al. (2005). This parallels the relationships between OEMs and tier 1 suppliers in traditional automotive value chains, as these relationships are also less hierarchical and more based on even power asymmetries. With tier 1 suppliers providing the OEMs with complex components and systems, the relationships are often characterized by collaborative partnerships as opposed to the relationships with smaller suppliers that offer generic, standardized products that tend to be more hierarchical and captive in nature (Brandes et al., 2013; Schwabe, 2020b; Sturgeon and Van Biesebroeck, 2011). The inter-firm relationships observed in our case studies take place on relatively equal terms, as the modularity of digital products like the navigation systems and the rising importance of specialized core competencies lead to more balanced negotiation and power relationships between the actors (Gereffi et al., 2005; Sturgeon, 2021). With only a few highly competent providers in the realm of navigation, the market for navigation systems is characterized not by price wars but by the quality and availability of services in a specific region of the world, thus forcing Chinese OEMs to localize the navigation services (at least partially) in Europe. As a result, OEMs become reliant on external sources of technology as well as on third parties (e.g. external specialized suppliers) offering complementary products and services, with an increased degree of co-creation and co-development between lead firms and suppliers.

Second, addressing the criticism that state players lack representation in the GPN framework (Yeung, 2018; Neilson et al., 2018), our examples demonstrate that standards and regulations serving as instruments of powerful institutional extra-firm actors (e.g. EU regulatory bodies) as defined by Coe and Yeung (2015) strongly impact the spatial and organizational configuration of GPNs (Dicken, 2015; Smith, 2015), as they determine market access, require the adaptation of products, and mould the relationships between lead firms and suppliers (Coe and Yeung, 2015). The previous sections have highlighted the forces that shape value creation for navigation systems in the European market as well as the roles that governmental institutions, road authorities, regulating agencies (e.g. EUSPA, 2023; OGC, 2023), directives, and laws (e.g. ISO, GDPR) play in the map creation process. The development of digital maps is highly dependent on local guidelines and regulations, as well as on spatially anchored value creation steps with tangible assets (e.g. street mapping survey vehicles and data infrastructure compliant with European regulations). These factors result in map providers specializing in certain world regions rather than providing global mapping services available worldwide. As a result, Chinese OEMs expanding to Europe seek partnerships with local navigation map providers to ensure accurate, compliant, and up-to-date maps for the European market. Although the digital component enables the connection of geographically distributed production networks, as value chains are modular and there are no geographical restrictions for the production of software, even spatially unbound digital technology providers are tied to a specific geographic location due to local regulations and standards as well as due to infrastructure access (designed by regulations). Furthermore, Chinese OEMs are influenced not only by homogeneous European laws and regulations but also by a heterogeneous landscape of directives from national mapping agencies and road authorities in the different European countries. This determines the spatial distribution of the value chain and influences supplier–buyer relationships.

As illustrated in Fig. 3, the case studies presented here indicate that OEMs outsource the mapping to external suppliers due to various regulations and due to the complexity of services that cannot be created in-house. In contrast, software is developed mostly internally, thus reflecting intra-firm coordination as conceptualized by Coe and Yeung (2015). While the navigation software consists of less complex mechanisms and tends to rely less on local regulations, it is transferable to Europe with minor adjustments, thus allowing firms to internalize critical technological resources for its creation in an effort to capture more value. As a result, it becomes clear that the two different types of inputs (for the navigation software and for mapping) lead to two different types of relationships (intra-firm coordination and “modular”).

Figure 3Organization and spatial distribution of value creation activities for vehicle navigation systems. Own adaptation.

To address our third research question, we examine the way in which value creation and the search for maximized value capture condition the strategic positioning of Chinese OEMs and their provision of navigation services in Europe. As shown in this paper, with the growing importance of data as a source of competitive advantage within the automotive sector, access to data can be seen as value sought after by OEMs and suppliers alike. Thus, the power struggle between OEMs and external partners manifests itself in the strategic control over user data and user experience, with the companies attempting to monopolize access to end customers (including their data and their purchasing power). For lead firms, establishing their own ecosystems with customer data and daily touchpoints (e.g. through software) is vital, as it opens up new business models, revenue streams, and data-driven development, as well as access to new markets and industries (Van Alstyne and Parker, 2017). Hence, the navigation software represents a point of competition with the mapping providers (or new industry entrants like Google Maps, Android Auto, etc.) that seek to install their own software interface in the cars. The monopolization of customer access can therefore be categorized as a type of value that companies seek to capture in the digital sector. Taking this into account, our findings lead to the question of what value means for the lead firms. As we examined the structuring factors for organization and spatial distribution (e.g. the regulations and the physical infrastructure needed for value creation), our case studies showed which assets lead firms aim to acquire in their pursuit of value capture (e.g. data). As various companies consider distinct factors (e.g. technical know-how, profit maximization) to represent value, the concept of value is subjective: while some Chinese OEMs, like BYD, NIO, and XPeng are attempting to take over value creation steps in-house (e.g. through the navigation software), others, like Aiways, are rather concerned with cutting costs and maximizing sales and thus do not aim to internalize data-based services. Therefore, whether a relationship with a supplier is even established depends on the strategic priorities of the OEMs.

Resulting from the case studies presented in this paper, it can be determined that different types of digital products are spatially transferable to different degrees (software transferable across distance and regulatory regimes vs. digital products like maps that are not transferable due to compliance and infrastructure constraints), thus requiring companies to react accordingly to different types of digital products. Hence, the characteristics of digital products and their implications (mostly influenced by standards and regulations) impact the companies' value creation strategies regarding outsourcing and the types of inter-firm relationships between lead firms and their specialized suppliers.

In conclusion, all of the factors discussed above affect the way in which individual firms seek to capture value: the characteristics of digital products (Sturgeon, 2021), the aim to control key technologies and data, and the significance of data as an asset (Lechowski and Krzywdzinski, 2022; Zook and Grote, 2025), as well as geographical restrictions and regulations as instruments employed by institutional extra-firm actors (Coe and Yeung 2015). In the pursuit of value capture, the dynamics of inter-firm competition and collaboration are reshaped in digital GPNs, which in turn influence the modular inter-firm relationships between OEMs and their suppliers (Gereffi et al., 2005).

This article delved into the elements shaping the value creation process for automotive navigation systems, particularly focusing on the inter-firm relationships between Chinese OEMs (automotive lead firms) expanding to Europe and their specialized suppliers. The findings have shown how factors like regulatory frameworks and the increasing importance of data influence the value creation strategies of Chinese OEMs and make them reliant on European and US service providers when expanding to the European market, as well as how the companies react to different types of spatially anchored and spatially unanchored digital products in their pursuit of maximizing value capture.

Adding to the current geography debates surrounding the digitization of GVCs and GPNs, this case study has given a glimpse into the transformation of digital production networks in regard to value chain governance and firm-specific strategies within automotive GPNs, particularly regarding a shift towards less hierarchical and more balanced power relations due to the growing complexity of digital products and the strategic positioning of firms seeking enhanced value capture. Based on the interviews and case studies presented, we have shown that the theoretical concepts of GVCs and GPNs should be re-evaluated in light of the digitization processes occurring. In particular, the role of standards and regulations (as instruments through which regulatory bodies exercise institutional power) that shape digital production networks should be given more attention, while the concepts of value and spatiality in GPNs with digital value chains should be examined more closely and re-defined.

As our study mainly focuses on value creation, further research should also consider the steps involved in value capture as well as market capture. Furthermore, the study conducted for this paper was limited to four Chinese OEMs with a relatively low number of interviews, so it cannot claim to be representative of the industry as a whole. Further empirical validation of the findings of this study may be obtained through analysis of localization strategies from other Chinese and non-Chinese OEMs regarding navigation systems and digital products in general. In addition, while it was shown in this paper how digital transformations are fundamentally reshaping GPNs, geopolitical uncertainties, trade disruptions, and the weaponization of dependencies (Kalvelage and Tups, 2024; Gong et al., 2022) are current topics impacting the automotive industry that also merit further empirical investigation.

Data are available on request due to privacy restrictions.

AS was responsible for the data curation, formal analysis, and writing of the original draft, while JS performed the conceptualization, as well as the writing review and editing.

The contact author has declared that neither of the authors has any competing interests.

Publisher's note: Copernicus Publications remains neutral with regard to jurisdictional claims made in the text, published maps, institutional affiliations, or any other geographical representation in this paper. While Copernicus Publications makes every effort to include appropriate place names, the final responsibility lies with the authors.

We express our sincere gratitude to the German Research Foundation (Deutsche Forschungsgemeinschaft, DFG) for funding this research project, to the anonymous reviewers whose constructive feedback helped improve the quality of the article, and to all interview partners who shared their valuable insights.

This research has been supported by the German Research Foundation (Deutsche Forschungsgemeinschaft, DFG), grant no. 492601593.

This paper was edited by Alexander Vorbrugg and reviewed by four anonymous referees.

ACEA – European Automobile Manufacturers' Association: Fact sheet: EU-China vehicle trade, https://www.acea.auto/fact/fact-sheet-eu-china-vehicle-trade/ (last access: 5 May 2025), 2023.

Agostino, M., Giunta, A., Nugent, J. B., Scalera, D., and Trivieri, F.: The importance of being a capable supplier: Italian industrial firms in global value chains, Int. Small Business J., 33, 708–730, https://doi.org/10.1177/0266242613518358, 2015.

Aiways: Aiways kooperiert mit PUMP zur Routen- und Ladeplanung für Elektrofahrzeuge in ganz Europa, https://media.ai-ways.eu/de/2022/aiways-kooperiert-mit-pump-zur-routen-und-ladeplanung (last access: 5 May 2025), 2022.

Alvarez León, L. F. and Aoyama, Y.: Industry emergence and market capture: The rise of autonomous vehicles, Technol. Forecast. Social Change, 180, 121661, https://doi.org/10.1016/j.techfore.2022.121661, 2022.

Attoh, K., Wells, K., and Cullen, D.: `We're building their data': Labor, alienation, and idiocy in the smart city, Environ. Plan. D, 37, 1007–1024, https://doi.org/10.1177/0263775819856626, 2019.

Barnes, T. J. and Sheppard, E.: Economic Geography, in: International Encyclopedia of Geography, edited by: Richardson, D., Castree, N., Goodchild, M. F., Kobayashi, A., Liu, W., and Marston, R. A., Wiley, https://doi.org/10.1002/9781118786352.wbieg0844.pub2, 2024.

Boes, A. and Ziegler, A.: Umbruch in der Automobilindustrie. Analyse der Strategien von Schlüsselunternehmen an der Schwelle zur Informationsökonomie, https://idguzda.de/forschungsreport-automobilindustrie/ (last access: 5 May 2025), 2021.

Brandes, O., Brege, S., and Brehmer, P.-O.: The Strategic Importance of Supplier Relationships in the Automotive Industry, Int. J. Eng. Business Manage., 5, 9, https://doi.org/10.5772/56257, 2013.

Braun, A., Koch, A., and Hochschild, V.: Intraregionale Unterschiede in der Carsharing-Nachfrage: Eine GIS-basierte empirische Analyse [Intraregional differences in car sharing demand: A GIS-based empirical analysis], disP – Plan. Rev., 52, 72–85, https://doi.org/10.1080/02513625.2016.1171051, 2016.

Briken, K., Chillas, S., Krzywdzinski, M., and Marks, A. (Eds.): The New Digital Workplace: How New Technologies Revolutionise Work, Red Globe Press, UK, 288 pp., ISBN 1137610131, 2017.

Burgard, J.: Quo Vadis, Chinese OEMs in Europe? Part 1, Berylls, https://www.berylls.com/quo-vadis-chinese-oems-in-europe/ (last access: 5 May 2025), 2022.

Butollo, F., Gereffi, G., Yang, C., and Krzywdzinski, M.: Digital transformation and value chains: Introduction, Global Networks, 22, 585–594, https://doi.org/10.1111/glob.12388, 2022.

Choi, S., Thalmayr, F., Wee, D., and Weig, F.: Advanced driver-assistance systems: Challenges and opportunities ahead, McKinsey & Company, https://www.mckinsey.com/industries/semiconductors/our-insights/advanced-driver-assistance-systems-challenges-and (last access: 5 May 2025), 2016.

Coe, N. M. and Yeung, H. W.: Global Production Networks. Theorizing Economic Development in an Interconnected World, Oxford University Press, UK, 256 pp., ISBN 9780198703914, 2015.

Corwin, S., Jameson, N., Pankratz, D. M., and Willigmann, P.: The future of mobility: What's next?, Deloitte University Press, https://www2.deloitte.com/content/dam/insights/us/articles/3367_Future-of-mobility-whats-next/DUP_Future-of-mobility-whats-next.pdf (last access: 5 May 2025), 2016.

Dicken, P.: Global Shift: Mapping the Changing Contours of the World Economy. in: 7th Edn., Guilford Publications, USA, 648 pp., ISBN 1446282104, 2015.

Dirscherl, H.-C.: Android Auto im Test: Funktionen, Apps, Auto-Hersteller, Varianten, PC Welt, https://www.pcwelt.de/article/1161010/android-auto-im-test-funktionen-apps-auto-hersteller-varianten.html (last access: 5 May 2025), 2023.

dpa: Das Auto der Zukunft kommt zu großen Teilen aus China, https://www.wiwo.de/unternehmen/auto/auto-shanghai-das-auto-der-zukunft-kommt-zu-grossen-teilen (last access: 5 May 2025), 2023.

Dutka, V.: Digital Mapping: Connecting the Dots to Drive Decisions, Intellias, https://intellias.com/digital-mapping-technology/ (last access: 5 May 2025), 2023.

Dyer, C., Holmes, F., and Hunsley, J.: New UX expectations are shifting automotive's focus, Automotive World, https://www.automotiveworld.com/articles/new-ux-expectations-are-shifting-automotives-focus/ (last access: 5 May 2025), 2022.

EDPB – European Data Protection Board: Guidelines 01/2020 on processing personal data in the context of connected vehicles and mobility related applications, https://edpb.europa.eu/our-work-tools/our-documents/guidelines/guidelines-012020-processing-personal-data-context_en (last access: 5 May 2025), 2021.

Esri: European Cadastres and National Mapping Agencies, https://www.esri.com/news/arcnews/spring11articles/european-cadastres-and-national-mapping-agencies.html (last access: 5 May 2025), 2011.

EU-ICIP: 14. Local authority aspects, https://www.mobilityits.eu/local-authority-aspects (last access: 5 May 2025), 2022.

EUR-Lex: Document 32019L1936, http://data.europa.eu/eli/dir/2019/1936/oj (last access: 5 May 2025), 2019.

EUR-Lex: Document 32021R1958, https://eur-lex.europa.eu/eli/reg_del/2021/1958/oj (last access: 5 May 2025), 2021.

Euromonitor International: In-Car Navigation Goes Smart, https://www.euromonitor.com/article/in-car-navigation-goes-smart (last access: 5 May 2025), 2016.

European Commission: Road infrastructure guidelines: New EU-wide guidelines to assess safety of road infrastructure, https://road-safety.transport.ec.europa.eu/eu-road-safety-policy/priorities/infrastructure/road-infrastructure-guidelines_en (last access: 5 May 2025), 2023.

EUSPA: What we do, https://www.euspa.europa.eu/about/what-we-do (last access: 5 May 2025), 2023.

Ezell, S.: How Innovative Is China in the Electric Vehicle and Battery Industries?, ITIF Information Technology & Innovation Foundation, https://itif.org/publications/2024/07/29/how-innovative-is-china-in-the-electric-vehicle-and-battery (last access: 5 May 2025), 2024.

Ferreri, M. and Sanyal, R.: Platform economies and urban planning: Airbnb and regulated deregulation in London, Urban Stud., 55, 3353–3368, https://doi.org/10.1177/0042098017751982, 2018.

Foster, C.: Theorizing globalized production and digitalization: Towards a re-centering of value, Competit. Change, 28, 189–208, https://doi.org/10.1177/10245294231193083, 2023.

Friedel, A.: Watch out, more Chinese OEMs are coming to Europe, some are already here, LinkedIn, https://www.linkedin.com/posts/friedel_china-car-ev-activity-6964541455994363904-4iX4 (last access: 5 May 2025), 2022.

Gao, P., Kaas, H.-W., Mohr, D., and Wee, D.: Automotive revolution – perspective towards 2030, McKinsey, https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/disruptive-trends-that-will-transform-the-auto-industry/de-DE (last access: 5 May 2025), 2016.

Gereffi, G., Humphrey, J., and Sturgeon, T.: The governance of global value chains, Rev. Int. Polit. Econ., 12, 78–104, https://doi.org/10.1080/09692290500049805, 2005.

Gerster, M.: Christoph Hartung – `Integration in die digitale Welt', Automobilwoche, https://www.automobilwoche.de/bc-online/interview-mit-bosch-experte-christoph-hartung-uber-das (last access: 5 May 2025), 2022.

Gibbs, N.: Xpeng pulls lidar from G9 to keep costs down, Automotive News, https://www.autonews.com/china/xpeng-undercuts-bmw-audi-price-europe (last access: 5 May 2025), 2023.

Gong, H., Hassink, R., Foster, C., Hess, M., and Garretsen, H.: Globalisation in reverse? Reconfiguring the geographies of value chains and production networks, Cambridge J. Reg. Econ. Soc., 15, 165–181, https://doi.org/10.1093/cjres/rsac012, 2022.

Grabher, G. and Van Tuijl, E.: Uber-production: From global networks to digital platforms, Environ. Plan. A, 52, 1005–1016, https://doi.org/10.1177/0308518X20916507, 2020.

Hagenmaier, M., Bert, J., Wegscheider, A. K., Palme, T., Kirn, R., and Schaber, L.: How to Profit in Tomorrow's Automotive and Mobility Industry, Boston Consulting Group, https://www.bcg.com/publications/2023/profiting-in-the-future-of-automotive-industry (last access: 5 May 2025), 2023.

Hägler, M.: Fahrzeuge chinesischer Firmen, überall, Zeit Online, https://www.zeit.de/mobilitaet/2023-04/auto-shanghai-2023-autoindustrie-china-deutsche-autobauer (last access: 5 May 2025), 2023.

Harris, S.: Global Navigation Satellite System (GNSS) and satellite navigation explained, Advanced Navigation, https://www.advancednavigation.com/tech-articles/global-navigation-satellite-system-gnss-and-satellite-navigation (last access: 5 May 2025), 2023.

Hattula, S., Reers, J., Eversmann, K., Kleikamp, C., and van Durme, J.: Monetizing Digital Services in Automotive, Accenture, https://www.accenture.com/content/dam/accenture/final/industry/mobility/document/Accenture-Monetizing-Digital-Services-in-Automotive.pdf (last access: 5 May 2025), 2023.

He, H. and Jin, L: How China put nearly 5 million new energy vehicles on the road in one decade, International Council on Clean Transportation, https://theicct.org/how-china-put-nearly-5-million-new-energy-vehicles-on-the (last access: 5 May 2025), 2021.

Helbig, N., Proff, H., and Nagl, M.: The Future of the Automotive Value Chain: Supplier industry outlook 2025, Deloitte, https://www2.deloitte.com/content/dam/Deloitte/us/Documents/consumer-business/us-cb-future-of-the-automotive-supplier-industry-outlook.pdf (last access: 5 May 2025), 2017.

Henderson, J., Dicken, P., Hess, M., Coe, N., and Yeung, H. W.-C.: Global production networks and the analysis of economic development, Rev. Int. Polit. Econ., 9, 436–464, https://doi.org/10.1080/09692290210150842, 2002.

Henßler, S.: XPeng Motors: Das plant das Start-up für Europa, Elektroauto-News.net, https://www.elektroauto-news.net/news/xpeng-motors-plan-fuer-europa (last access: 5 May 2025), 2023.

HERE: Features and attributes, https://developer.here.com/documentation/mapping-concepts/white_paper/topics/features-attributes.html (last access: 5 May 2025), 2023.

Hoeft, F.: Fun to drive? The dynamics of car manufacturers' differentiation strategies, Strateg. Change, 30, 489–500, https://doi.org/10.1002/jsc.2463, 2021.

Horner, R.: Beyond facilitator? State roles in global value chains and global production networks, Geogr. Compass, 11, e12307, https://doi.org/10.1111/gec3.12307, 2017.

Howson, K., Ferrari, F., Ustek-Spilda, F., Salem, N., Johnston, H., Katta, S., Heeks, R., and Graham, M.: Driving the digital value network: Economic geographies of global platform capitalism, Global Networks, 22, 631–648, https://doi.org/10.1111/glob.12358, 2022.

Industry Research: Global Car Navigation Systems Market Size, Manufacturers, Supply Chain, Sales Channel and Clients, 2024–2030, https://www.industryresearch.co/global-car-navigation-systems-market-28248544 (last access: 5 May 2025), 2024.

Infopulse: Modern Car Navigation Systems and Their Features, https://www.infopulse.com/blog/modern-car-navigation-systems-and-their-features (last access: 5 May 2025), 2022.

Kalvelage, L. and Tups, G.: Friendshoring in global production networks: state-orchestrated coupling amid geopolitical uncertainty, ZFW – Adv. Econ. Geogr., 68, 151–166, https://doi.org/10.1515/zfw-2024-0042, 2024.

Kano, L., Tsang, E. W. K., and Yeung, H. W.-C.: Global value chains: A review of the multi-disciplinary literature, J. Int. Business Stud., 51, 577–622, https://doi.org/10.1057/s41267-020-00304-2, 2020.

Lechowski, G. and Krzywdzinski, M.: Emerging positions of German firms in the industrial internet of things: A global technological ecosystem perspective, Global Networks, 22, 666–683, https://doi.org/10.1111/glob.12380, 2022.

Lehle, A.: Update NIO Navigation: Ortsangaben werden jetzt von Google bereitgestellt, NIO App, https://m.eu.nio.com/module_10007/content?is_nav_show=false&id=6g1Yc1VAnh7dzOMR&lang=en®ion=DE&type=article (last access: 5 May 2025), 2023.

Liu, J. and Tylecote, A.: Corporate Governance and Technological Capability Development: Three Case Studies in the Chinese Auto Industry, Industry and Innovation, Taylor & Francis J., 16, 525–544, https://doi.org/10.1080/13662710903053805, 2009.

Loonam, J. and O'Regan, N.: Global value chains and digital platforms: Implications for strategy, Strateg. Change, 31, 161–177, https://doi.org/10.1002/jsc.2485, 2022.

McDee, M.: Nio is preparing to enter Portugal – NAD mapping has started, ArenaEV, https://www.arenaev.com/nio_is_preparing_to_enter_portugal__mapping_for_nad_has_started-news-489.php (last access: 5 May 2025), 2022.

Michaelsen, E., Størda, G. F., and Nyberg, T. E.: Automotive Data Sharing, KPMG Digital, https://assets.kpmg.com/content/dam/kpmg/no/pdf/2020/11/Automotive_Data_Sharing_Final Report_SVV_KPMG.pdf (last access: 5 May 2025), 2020.

Mordor Intelligence: Automotive Navigation System Market Size & Share Analysis – Growth Trends & Forecasts (2025–2030), https://www.mordorintelligence.com/industry-reports/automotive-navigation-system (last access: 5 May 2025), 2025.

Neilson, J., Pritchard, B., Fold, N., and Dwiartama, A.: Lead firms in the cocoa–chocolate global production network: An assessment of the deductive capabilities of GPN 2.0, Econ. Geogr., 94, 400–424, https://doi.org/10.1080/00130095.2018.1426989, 2018.

OBP – Online Browsing Platform: ISO/TR 19121:2000(en): Geographic information – Imagery and gridded data, https://www.iso.org/obp/ui/#iso:std:iso:tr:19121:ed-1:v1:en (last access: 5 May 2025), 2000.

OBP – Online Browsing Platform: ISO 19133:2005(en): Geographic information – Location-based services – Tracking and navigation, https://www.iso.org/obp/ui/#iso:std:iso:19133:ed-1:v1:en (last access: 5 May 2025), 2005.

OGC – Open Geospatial Consortium: About, https://www.ogc.org/about-ogc/ (last access: 5 May 2025), 2023.

Pavlínek, P.: Global Production Networks, Foreign Direct Investment, and Supplier Linkages in the Integrated Peripheries of the Automotive Industry, Econ. Geogr., 94, 141–165, https://doi.org/10.1080/00130095.2017.1393313, 2018.

Pavlínek, P. and Ženka, J.: Value creation and value capture in the automotive industry: Empirical evidence from Czechia, Environ. Plan. A, 48, 937–959, https://doi.org/10.1177/0308518X15619934, 2016.

Perkins, G. and Murmann, J. P.: What Does the Success of Tesla Mean for the Future Dynamics in the Global Automobile Sector?, Manage. Organiz. Rev., 14, 471–480, https://doi.org/10.1017/mor.2018.31, 2018.

Ponte, S. and Sturgeon, T.: Explaining governance in global value chains: a modular theory-building effort, Rev. Int. Polit. Econ., 21, 195–223, https://doi.org/10.1080/09692290.2013.809596, 2014.

Research and Markets: Automotive Navigation Systems Market Report 2025, https://www.researchandmarkets.com/reports/5953392/automotive-navigation-systems-market-report (last access: 5 May 2025), 2025.

Schwabe, J.: From `obligated embeddedness' to `obligated Chineseness'? Bargaining processes and evolution of international automotive firms in China's New Energy Vehicle sector, Growth Change, 51, 1102–1123, https://doi.org/10.1111/grow.12393, 2020a.

Schwabe, J.: Risk and counter-strategies: The impact of electric mobility on German automotive suppliers, Geoforum, 110, 157–167, https://doi.org/10.1016/j.geoforum.2020.02.011, 2020b.

Smith, A.: The state, institutional frameworks and the dynamics of capital in global production networks, Prog. Hum. Geogr., 39, 290–315, https://doi.org/10.1177/0309132513518292, 2015.

Stallkamp, M. and Schotter, A.: Platforms without borders? The international strategies of digital platform firms, Global Strat. J., 11, 58–80, https://doi.org/10.1002/gsj.1336, 2018.

Sturgeon, T. J.: Upgrading strategies for the digital economy, Global Strat. J., 11, 34–57, https://doi.org/10.1002/gsj.1364, 2021.

Sturgeon, T. J. and Van Biesebroeck, J.: Global value chains in the automotive industry: An enhanced role for developing countries?, Int. J. Technol. Learn. Innov. Dev., 4, 181–205, https://doi.org/10.1504/IJTLID.2011.041904, 2011.

Sturgeon, T. J., Van Biesenbroeck, J., and Gereffi, G.: Value chains, networks and clusters: reframing the global automotive industry, J. Econ. Geogr., 8, 297–321, https://doi.org/10.1093/jeg/lbn007, 2008.

Teece, D. J.: Tesla and the Reshaping of the Auto Industry, Manage. Organiz. Rev., 14, 501–512, https://doi.org/10.1017/mor.2018.33, 2018.

Telenav: Telenav to provide EV navigation for Xpeng's European customers, https://www.telenav.com/press-releases/2021-01-11-telenav-to-provide-ev-navigation-for-xpengs (last access: 5 May 2025), 2021.

Thun, E.: Changing Lanes in China: Foreign Direct Investment, Local Governments, and Auto Sector Development, Cambridge University Press, 344 pp., ISBN 0521843820, 2006.

Tian, J., Wang, P., and Zhu, D.: Overview of Chinese new energy vehicle industry and policy development, Green Energ. Resour., 2, 100075, https://doi.org/10.1016/j.gerr.2024.100075, 2024.

2265 Android Network (2265 Anzhuo wang): Che ji ban ditu app xiazai heji [Car version map app download collection], http://www.2265.com/k/cjbdt/ (last access: 5 May 2025), 2023.

Van Alstyne, M. and Parker, G.: Platform Business: From Resources to Relationships, GfK Market. Intel. Rev., 9, 24–29, https://doi.org/10.1515/gfkmir-2017-0004, 2017.

Van Tuijl, E., Carvalho, L., and Dittrich, K.: Beyond the joint-venture: knowledge sourcing in Chinese automotive events, Indust. Innov., 25, 389-407, https://doi.org/10.1080/13662716.2017.1414749, 2018.

Van Tuijl, E., Dittrich, K., and van der Borg, J.: Upgrading of Symbolic and Synthetic Knowledge Bases: Evidence from the Chinese Automotive and Construction Industries, Indust. Innov., 23, 276–293, https://doi.org/10.1080/13662716.2015.1129316, 2016.

Verfürth, P. and Helwing-Hentschel, V.: Digital platforms and the reconfiguration of global production networks, J. Econo. Geogr., 25, 235–253, https://doi.org/10.1093/jeg/lbae039, 2024.

Wolford, B.: What is GDPR, the EU's new data protection law?, GDPR.EU, https://gdpr.eu/what-is-gdpr/?cn-reloaded=1 (last access: 5 May 2025), 2023.

Woodcock, J. and Graham, M.: The Gig Economy: A Critical Introduction, Polity Press, UK, 160 pp., ISBN 1509536353, 2019.

Yang, J. Y., Gu, Y., and Tan, Z. L.: Chinese Electric Vehicle Trailblazers: Navigating the Future of Car Manufacturing, Springer Nature, Switzerland, 147 pp., ISBN 303125144X, 2023.

Yang, Z.: How did China come to dominate the world of electric cars?, MIT Technology Review, https://www.technologyreview.com/2023/02/21/1068880/how-did-china-dominate-electric-cars-policy/ (last access: 5 May 2025), 2023.

Yeung, G.: `Made in China 2025': The development of a new energy vehicle industry in China, Area Dev. Policy, 4, 39–59, https://doi.org/10.1080/23792949.2018.1505433, 2018.

Yeung, G.: Competitive dynamics of lead firms and their systems suppliers in the automotive industry, EPA: Econ. Space, 56, 454-475, https://doi.org/10.1177/0308518X231202390, 2023.

Zavadko, V.: Digital Mapping: Connecting the Dots to Drive Decisions, Intellias, https://intellias.com/digital-mapping-technology/ (last access: 5 May 2025), 2023.

Zhang, P.: NIO releases new version of NIO OS, bringing highly anticipated Gaode Map, CnEVPost, https://cnevpost.com/2022/04/08/nio-releases-new-version-of-nio-os-bringing-highly-anticipated (last access: 5 May 2025), 2022.

Zook, M. and Grote, M.: Global digital networks, Cambridge J. Reg. Econ. Soc., 18, 93–110, https://doi.org/10.1093/cjres/rsae039, 2025.

- Abstract

- Introduction

- Research aims and exploratory questions

- Conceptual frame: organization and spatial distribution of digital value creation activities

- The new perception of cars and the importance of navigation systems

- Navigation software in the new-generation Chinese EVs exported to Europe

- Discussion

- Conclusion and outlook

- Data availability

- Author contributions

- Competing interests

- Disclaimer

- Acknowledgements

- Financial support

- Review statement

- References

- Abstract

- Introduction

- Research aims and exploratory questions

- Conceptual frame: organization and spatial distribution of digital value creation activities

- The new perception of cars and the importance of navigation systems

- Navigation software in the new-generation Chinese EVs exported to Europe

- Discussion

- Conclusion and outlook

- Data availability

- Author contributions

- Competing interests

- Disclaimer

- Acknowledgements

- Financial support

- Review statement

- References