the Creative Commons Attribution 4.0 License.

the Creative Commons Attribution 4.0 License.

Challenging global changes in a post-revolutionary context: the case of irrigated olive growing in central Tunisia

Pepita Ould Ahmed

Philippe Cadène

Ismail Chiab

Vassili Kypreos

Research on agricultural development models shows that local applications of global models are adapted both to the globalisation of agricultural markets and to climate change. The circulation of such models is also linked to local political and historical contexts. However, few studies have focused on abrupt changes in economic policies, such as those following the Arab Spring. We propose to study the evolution of olive-growing development policies in post-revolutionary Tunisia. In order to mitigate both market- and climate-induced vulnerabilities and to make the sector more competitive with major olive producers, Food and Agriculture Organization (FAO) guidelines recommend intensification of Tunisian olive farming through irrigation. Our research makes two main claims: (1) the change in the production model towards irrigation aims to respond to globalisation, climate change and national policies. (2) Some exporters are involved at several levels of the value chain. This research conducted by geographers and economists analyses the mutations of the olive sector towards irrigation, using a double theoretical framework on the circulation of agricultural development models, with a political-ecology approach. This paper contributes to a growing body of research on the relationship between commodity production networks and water studies.

- Article

(3764 KB) - Full-text XML

- BibTeX

- EndNote

Although it has only contributed to 3 % of the global market for edible oil over the past decade (between 2.9 % and 3.1 % from 2013/14 to 2019/20; Statista, https://www.statista.com/statistics/613466/olive-oil-production-volume-worldwide, last access: 29 August 2023), olive oil is increasingly consumed on an international scale. It is estimated that consumption has increased from 1.67 to 3.23 million t from 1990/91 to 2019/20 (International Olive Council, https://www.internationaloliveoil.org/, last access: 29 August 2023). In this rapidly expanding global market, Tunisia is one of the major producers and exporters, with strong interannual variations in production depending on rainfall. For example, the country was the second-largest producer in the world in 2014/15 but the sixth largest in 2019/20; as regards exports, Tunisia was third in the world in 2013/14, first in 2014/15 and second in 2019/20. Exports are mainly in bulk, but the marketing of bottles began between 2008 and 2010, accounting for 7.4 % of exported volume in 2020 (Office National de l'Huile, http://www.bulletin.onh.com.tn/, last access: 29 August 2023). With 71 % of volume exported as extra virgin oil in 2019 and 22 % as organic oil in 2017/18, oils meet European and US standards for quality.

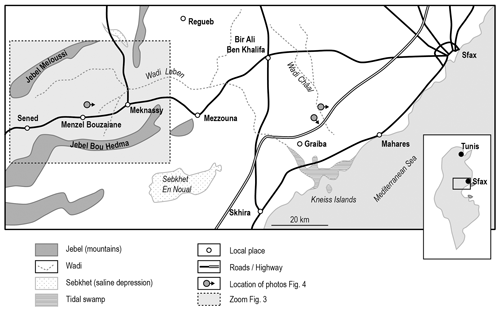

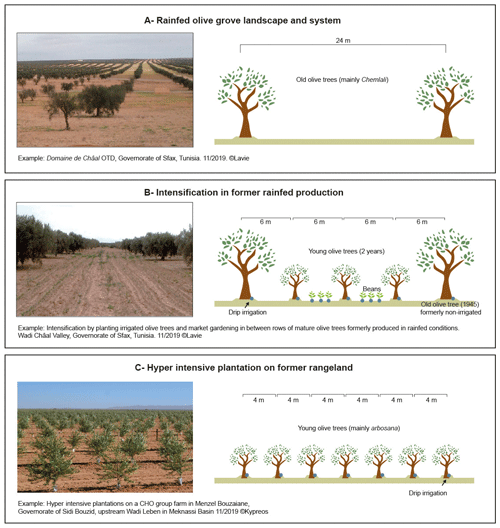

The central Tunisian region where we conducted this study (Fig. 1) accounts for one-third of national olive oil production or an average of 50 000 t yr−1 recently (International Olive Council, online). Production was encouraged under the French protectorate (1881–1956) (Poncet, 1961). Since then, the landscape of central Tunisia has consisted of endless rows of olive trees, spaced about 17–24 m apart (Fig. 3a). Production is mainly rainfed, with so-called rescue irrigation using a tank or hose during very dry summers. The dependence of production (and therefore of exports) on rainfall patterns is significant, since an olive tree only produces fruit every 3 years on average. The specialised literature also considers the Mediterranean Basin a hot spot for climate change (Giorgi, 2006) and emphasises the increasing frequency of hydro-climatic extremes (Raymond et al., 2018; Tuel and Eltahir, 2020).

Moreover, the olive sector in Tunisia has undergone several varieties of structural changes from its establishment during the protectorate era. The first one is the co-op system and the nationalisation of major French societies after independence; the second, beginning in the mid-1980s, was fuelled by public policies advocating the liberalisation of the economy as a whole; the third, beginning in the mid-1990s, was fuelled by a national economic policy oriented towards exportation. The political instability experienced since the revolution in 2010–2011 has led to upheavals in the olive oil marketing sector. In these successive politico-economic contexts, the export of olives has shifted over the last 25 years from a public monopoly to a private one.

This paper highlights the challenges faced by the Tunisian oil sector on multiple scales: global economic issues, regional climate issues and national political issues. On a global scale, the sector must remain competitive in a market dominated by southern Europe, with Spain and Italy at the forefront. Therefore Tunisia is looking for market shares elsewhere, such as in Canada or the United States, in order to diversify its exports (Office National de l'Huile, online). On a regional level, the Mediterranean region has a transitional climate between that of the Sahara and that of Europe. Its geographical location makes the region especially vulnerable to climate variations. Its qualification as a “hot spot” comes from a regional climate change index (RCCI) which identifies the regions most vulnerable to climate change (Giorgi, 2006; Giorgi and Lionello, 2008). Changes in atmospheric circulation are leading to profound changes in climate (Daoud and Dahech, 2017). Current trends in climate variables are set to continue in the future, with an expected increase in average temperature (Zaied and Zouabi, 2016), a decrease in precipitation and an increase in extreme events. Thus, increasingly dry climatic conditions are anticipated, during both summer (Giorgi and Lionello, 2008; Jacobeit et al., 2014) and winter (Raymond et al., 2018; Tuel and Eltahir, 2020). From a water resource point of view, the consequences of these changes are numerous: reduced soil water retention, increased runoff, changes in river regimes and flows, reduced groundwater recharge, and increased physiological needs (Vicente-Serrano et al., 2014). A quantitative decrease in groundwater and surface-water resources is, therefore, expected in the future (Chaouche et al., 2010; Cohen et al., 2014). Central Tunisia is part of this special climatic context: the nearby Gulf of Gabes is a contact zone between “disturbances from temperate climate zones to the north” and “stabilising anticyclones from subtropical zones to the south” (Fautras, 2021:38).1 The interdependence between the climate and arable land on the one hand and water resources on the other is obvious. Climate change makes olive growing increasingly vulnerable. Lastly, on a national level, in the framework of neoliberal politics of the late 20th century, the Tunisian authorities introduced structural changes in Tunisian agriculture by supporting the general liberalisation of the national economy since 1986, via a structural adjustment programme (Chaker, 1997; Jouili et al., 2013) and an export-oriented economic policy (Ould Ahmed et al., 2019). However this political context was also based on an earlier policy of integrating agricultural products into globalised trade, partly forming olive oil, which can be called a cash economy (Fakhfakh, 1975).

Our research aims to understand how the olive oil sector in central Tunisia has been reorganised in this post-revolutionary context. We question the application, at the local level, of a model of transfer and the dissemination of global techniques, practices and norms, in the context of a rather uncertain national future. The thesis developed here is that the application of a more global model on a local scale takes place in a paradoxical context: there is an incentive to produce for export while climate change implies a decrease in the water resources available for irrigation. Following this introduction, a review of the relevant scientific literature (Sect. 2) enables us to consider our first hypothesis: the transition observed today is based on policies and modes of production that prevailed long before the 2010–2011 revolution. Part 3 presents the research methodology. Our second hypothesis is that the revolution transformed power relations: the downstream actors – the exporters – were given a monopoly on the management of the sector. This hypothesis will be discussed in Part 4. Our third hypothesis is that a Food and Agriculture Organization (FAO) report has only been partially applied in Tunisia. Indeed, the shifts in production and processing (crushing) led by exporters have been brutal, albeit still limited, with resistance from those connected to colonial rainfed olive groves and traditional oil mills as well as a certain hybridisation of production and processing models. Even in marketing, other alternative markets are opening up. This hypothesis will be discussed in Part 5.

The colonial, post-colonial and recent history of the Tunisian olive grove is marked by several successive models of agricultural development policies. This section presents the elements of the economic policy context which explain the basis on which the new model of intensive capitalist agriculture has taken root. We will then present the FAO (2015) report, which outlines the steps to be taken to modernise the sector. At the end of the section, we will put forward a typology of producers and processors that stems from these transformations.

2.1 A colonial legacy state export model: 1881–1970s

Tunisian olive oil had already been of interest to traders from France since the 16th century for the manufacturing of the famous Marseille soap (Frini, 2016), as well as to Italians (Laitman, 1953). The interest of the French colonists in olive growing in the Sfax Plain in particular began before the establishment of the protectorate in 1881 (Yazidi, 2011; Frini, 2016). “Tunisia was destined to become an important `partner' in the world market of olive trade. The protectorate held at the disposal of the Metropole, and well beyond, the quantities of oil that it needed, oil of a superior quality and a price significantly lower than Spanish oils. Indeed, throughout the colonial period, the main outlet for Tunisian oils remained essentially France, Algeria and Morocco”, but already “voices were raised to denounce this colonial policy of massive export to other markets and at prices unsatisfactory to Tunisian producers” (Frini, 2016; see also Davis, 2007).

The main olive-growing system that exists nowadays is a rainfed production system established under the French protectorate at the beginning of the 20th century (Poncet, 1961). Olive trees are generally planted in rows spaced 17–24 m apart. The establishment of a rainfed olive grove on the Sfax Plain is partly linked to trade links with the metropole, links encouraged by dedicated customs policies (Laitman, 1953; Frini, 2016): “The colonisation of Sfax and the development of the olive industry seem to have been aimed at guaranteeing the sale of olive oil in France” (Laitman, 1953:281).

After independence and a short collectivist period (see below), the 1970s were marked by the inclusion of domestic agriculture in the international division of labour (Elloumi, 2013). One of the symbols of this policy was the 1972 law “which instituted a special regime for foreign investments whose production was destined for export. This policy, which emphasised Tunisia's comparative advantage in terms of low wages, required the marketing of cheap agricultural products and, therefore, the control of their commercialisation” (Elloumi, 2013). State-owned land (Office des Terres Domaniales) – formerly colonial and unspoiled public land – and the National Oil Office (ONH – Office National de l'Huile) as a public body “were called upon to play a role in regulating the market by providing production for the domestic market and for export” (Elloumi, 2013).

As Tunisia moved into the era of liberalisation of its economy – and particularly its agricultural economy – in a favourable global context led by international financial institutions, the national olive oil model turn towards exports was already promising. Colonisation and the post-independence era had already laid the foundations of a so-called “modern” agriculture which became a model of agricultural development from the end of the 1980s. However, family and peasant agriculture has always resisted, crossing development policies (Fautras, 2021; fieldwork in 2019).

2.2 Modernisation policies and changing trajectories for the agricultural sector: the years 1980–1990

In 1986, a structural adjustment programme (plan d'ajustement structurel) supported industrial modernisation in order for the agricultural sector to be competitive and to integrate into international markets. In the 1990s, several reforms were oriented towards fiscal and administrative incentives and subsidies for exports, modernisation, irrigation and so on (Abaab and Elloumi, 1996; Elloumi, 2013; Ould Ahmed et al., 2019).

Regarding marketing, in 1994 the state ended its own monopoly on oil prices, which were previously set by the agricultural policy, and on the marketing chain. The dynamics of import and export of agricultural products by public bodies, including the National Oil Office (ONH – Office National de l'Huile) for the olive oil sector, were liberalised in order to align domestic prices to global levels and reduce subsidies to producers.

In 1995, the production sector was transformed, with the privatisation of the management of state-owned land. In fact, as early as 1983, it was possible to rent state farms to agricultural technicians with 40-year leases, renewable every decade (see Elloumi, 2013). In 1995, agricultural enhancement and development corporations (SMVDAs – Sociétés de mise en valeur et de développement agricole) were formalised (see below), with 30-year concessions on land from the former production cooperatives. They are based on megaprojects involving significant investments and advanced technologies. Some of these companies were even created by development banks supplied with capital from the Gulf states.

More specifically, a literature review highlights several stages of policies concerning water resources for irrigation. Land-use planning during the French protectorate and the first years of independence was marked by the state ownership of resources, which aimed to control space and populations (Bédoucha, 2000; Elloumi, 2013). However, the liberalisation of access to groundwater resources began with the implementation of a structural adjustment programme in 1986 (Jouili et al., 2013). First, the state instituted the creation of user groups now called agricultural development groups (GDAs – Groupements de développement agricole), whose function was the management of public irrigation facilities. The public hydraulic domain concerns spring water, wadis and groundwater. However, these state prerogatives over water resources were clearly reduced in the 1990s. The exploitation of groundwater for individual purposes allowed for the privatisation of the hydraulic public domain through a clear differentiation between the legal rights pertaining to water and land (Fautras, 2017:327). State water resources have thus been put at the service of private land resources (Jouili et al., 2013).

Set up in the context of the liberal reforms carried out during the 1990s, the GDAs correspond in theory to decentralised structures that should allow farmers to participate in the governance of resources and the management of public irrigated areas. In practice, they mainly contribute to the state's control of the rural population (Canesse, 2009). Fautras (2021:93ff.) explains this policy of supervising rural areas through the appropriation of land and water resources via state policies, which has occurred since the colonial period; has continued since independence, the Ben Ali period and the revolution; and still continues today.

2.3 The post-revolutionary era and the FAO report: the 2010s

National consumption of olive oil is significant, amounting to 25 % of local production in the early 2010s (FAO, 2015), mainly produced by small family farms (see below). However, it is declining in favour of less expensive vegetable oils and is not sufficient to make national production profitable. This follows policies that formerly reserved olive oil for export; therefore it is necessary to sell abroad. Producers are thus dependent on market dynamics in addition to their dependence on the climate. A report published by the UN Food and Agriculture Organization (FAO) on the Tunisian olive sector (FAO, 2015) makes a number of observations and proposes a series of recommendations concerning production. Yields, much lower than in most of the world's olive-growing systems, are declining and fluctuate greatly from year to year. The authors of the report argue this is due to lower planting density, old and poorly maintained trees, poor farming practices related to a lack of expertise, and limited sanitary protection. According to the FAO (2015) report, although labour remains inexpensive, its cost has increased since the revolution, and this comparative advantage is offset by low yields. To stabilise and increase yields, the FAO report recommends densifying production through drip irrigation and facilitating access to credit for olive growers who wish to access capital to equip their farms with hydraulic infrastructure. Irrigation and pressurised hydraulic techniques go hand in hand with a mechanisation of production that generate official employment, particularly for salaried workers, whereas rainfed cultivation often remains a form of unsalaried family production.

Although this report is critical of the Tunisian production system inherited form the protectorate era, it makes noteworthy recommendations to intensify production; to move from a rainfed to an irrigated, industrial system; and to increase the use of agricultural inputs. Communication is based on the concept of “modernisation” (Burt, 2013; Fautras, 2021). The model advocated is in fact that of Andalusia. What is the Andalusian model? Angles (2016) proposes a typology of two olive-growing models, which reveal a local–global dialectic. The Andalusian model seeks optimal productivity through lower production costs and selling prices. The dominant dynamic involves competition at the scale of the world market and a firm logic favoured by global governance. Products are generic and often sold in bulk. On the contrary, for instance, the French olive oil model seeks quality and typicality, which means highlighting the specificity of the products and seeking labels and denominations of origin. The objective is to escape from competition through the recognition of the territory, niche logic and local governance (Angles, 2016).

Regarding the production and processing systems in this case study area, the French system set up under the protectorate currently dominates the landscape. The current commercial logic is still oriented towards a dynamic of export and, therefore, a dynamic of global governance. Accordingly, we observe, at the local level, the implementation of a transfer of the production–processing model that is close to the Andalusian olive oil model. In fact, “modernisation of olive cultivation is closely linked to the phenomenon of globalisation in favour of a massification of production and a generalisation of the consumption of olive products” (Angles, 2016:56).

2.4 A plural history that leads to a typology of producers and transformers

Based on the works of Fakhfakh (1975) and Frini (2016), we were able to draw up a typology of producers and actors, among other stakeholders in the sector (Ould Ahmed et al., 2019).

-

Small family farms of less than 5 ha represent almost half of the olive farms nationwide (FAO, 2015). Production mostly occurs without mechanisation and inputs. Trees of the local `Chemlali' variety are often old (70 years). We surveyed some of these families: they often engage in other activities such as fishing in the Gulf of Gabes and collecting clams on the foreshore. Such families are generally not in the process of changing their system, extending the areas planted or resorting to irrigation. On the contrary, land fragmentation is more common due to inheritance (see Fautras, 2021). Most of a family's olive production that is brought to the oil mill is returned to them as oil. Only the surplus exceeding the family's annual needs is sold to the oil mill, which can then be resold to the domestic market.

-

Medium-sized family farms (5 to 20 ha) account for about 40 % of olive trees nationwide (FAO, 2015). Trees are as infrequently uprooted as on small farms, but species are more varied, with some Spanish `Arbosana' and Greek `Koroneiki', only for irrigation, among the local `Chemlali' majority. Some of these farms are trying to implement irrigation and the use of inputs on small areas, but there is no real expansion of the estates.

-

Finally, large farms (>20 ha) are of three types: state farms, agricultural enhancement and development corporations (SMVDAs; see below), and the capitalist enterprises. At the State Lands Office (OTD – Office des Terres Domaniales) in Châal, for example, there are 22 farms and 3 modern oil mills, one of which is for organic production. Trees are mostly rainfed (Fig. 3a), over 70 years old and of the local `Chemlali' variety. Trials of irrigation and the use of agricultural inputs are underway on some plots. There is no dynamic of expansion of the estates given that the national philosophy is rather to privatise. Some state-owned land has been leased since the 1990s to former employees, under the status of SMVDAs. Some of the SMVDAs that rented for several decades could eventually be transferred to the tenants. Finally, capitalist enterprises can lease state-owned land and develop it intensively, as is the case with the large group, CHO Group (see below). What differentiates the capitalist farms from the farms of the OTD and SMVDA is the policy of intensification and recourse to irrigation and agricultural inputs (a major factor for large farms, whereas it is marginal for smaller ones). The Spanish variety `Arbosana' is favoured for intensive irrigated production.

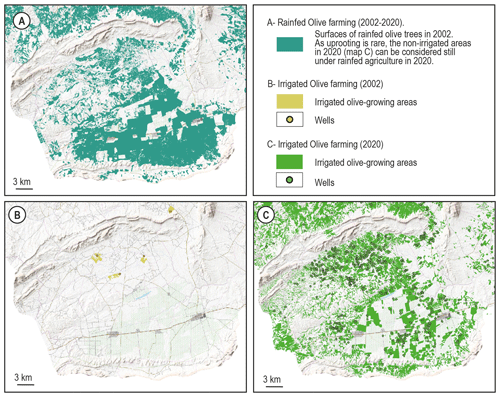

Figure 2Spatial extension of olive grove irrigation in the Meknassi Basin, diachronic analysis 2002–2020. Sources: digitisation by photointerpretation from images © Google Earth. © OpenStreetMap 2022. Distributed under the Open Data Commons Open Database License (ODbL) v1.0. topographic map base.

During the harvest season, which lasts from about December to March, the collection and transport of olives to mills are accomplished by several parties: the family (for small farms); employees (for state-owned land and large private groups); and two types of intermediaries – khaddars, very small companies that buy the olives on the tree, collect them and transport them to an oil mill, and kayals, which could be translated as “brokers”, who are traders and transporters. Kayals buy olives from the producers; estimate the price according to the quality and the probable oil content; and then sell this merchandise either to oil mills or at the olive market in Sfax, the souk.

The olives must be pressed within 48 h of harvesting for them to be of good quality. Oil mills can be traditional and local, with a crushing (trituration) capacity of about 20 t of olives per day. Some of them do not refine the oil, so it cannot be marketed. If an oil mill is modern, it must meet international export standards. Modern mills crush between 120 and 200 t of olives per day depending on their capacity. Storage is provided by the oil mill, and oil is sold when prices are favourable. The large public and private estates generally have their own oil mills, which is particularly useful for separating organic and non-organic production.

In the framework of the SAR-DYN Kneiss Programme funded by LabEx DynamiTe, integrating geographers and economists, we carried out two field missions (March 2019 and November 2019) in the central Tunisian region of the governorates of Sfax and Sidi Bouzid. There we carried out qualitative surveys with stakeholders in the sector. In addition, the PRPT (Personnel recruté sur place temporaire) programme funding from the French National Research Institute for Sustainable Development (IRD) allowed us to finance a diachronic mapping of olive-growing sectors by photointerpretation.

3.1 A qualitative survey of the olive sector

The choice was made to focus on the actors and stakeholders in the sector. Public data are interesting for making numerical analyses and general observations, but they do not shed light on choices and hesitations, family trajectories, and relations between actors. Qualitative surveys of stakeholders seemed to us to be the most suitable approach. We worked on two production areas of the Sfax Plain: the Wadi Leben basin, since it offers a transect from the marked reliefs to the side and thus covers a vast diversity of types of olive groves and access to irrigation water, the Wadi Châal basin, since this is where the main public state olive grove sector of the Sfax Plain is located. All oil processing and marketing actors, on the other hand, are located in the agglomeration of Sfax (Fig. 1). Our methodological approach is based on qualitative semi-structured interviews in Arabic or French that were mainly collective (focus groups). The responses to our questions reflect the specificity of this type of survey in small hierarchical groups. Fieldwork research material was analysed taking this context into account. The hesitations of certain private companies or public institutions to meet with French researchers were resolved thanks to the intervention of our colleagues from the University of Sfax, who organised the interviews for the binational team. Finally, a particularity of the study is that it took place during the Covid-19 pandemic. The international context led us to reorganise the survey work and slowed down the collection of information.

We conducted 18 individual or group interviews lasting 1 to 2 h. Upstream of the sector, we interviewed in a state-owned farm and owners of small- and medium-sized farms. In the case of smallholder families, olive growing is often not the primary occupation. Men are usually fishermen in the area, and women collect clams on the foreshore at the mouth of the Wadi Leben or on the shores of the Kneiss Islands (Fig. 1). We interviewed owners of traditional and modern oil mills that meet international import standards, as well as the director of an olive wood processing plant. We had several interviews with actors at different levels of the chain in the large private group, CHO Group (production, processing, laboratory, packaging and marketing). Finally, we interviewed researchers from the Olive Tree Institute in Sfax (Institut de l'Olivier).

3.2 Mapping the evolution of olive-growing areas

Diachronic mapping of the extension of olive-growing areas was carried out because such a map has not been produced by the authorities. This is because more than half of the existing wells are illegal (Fautras, 2021; field interview, CRDA – Centre Régional de Développement Agricole, in English the Regional Agricultural Development Centre). It is based on the digitisation of plots by photo interpretation of satellite images from © Google Earth in 2002 and 2020 which were of good resolution quality, at the scale of the two wadi catchments. Wells and plots of rainfed and irrigated olive cultivation were mapped for both years. The distinction between irrigated and non-irrigated lands has been made manually according to the number of trees per plot.

Regarding the synthesis carried out by the FAO (2015), Fautras's works (2017, 2021) and the 18 interviews we carried out in the study area, we affirm that the marketing chain has moved from a public monopoly to a private one in which half a dozen industrial groups dominate the sector. The end of state price fixing and marketing in 1994 liberalised the downstream part of the sector. The revolution, through the entrepreneurial freedom it allowed, accelerated the process despite an uncertain political context. This is so to such an extent that these private groups have invested at several levels of the sector, including production and land, in order to better control their costs.

4.1 Exporters' investment at all levels of the sector

All the actors we interviewed indicated that the negotiating power of the sector was in the hands of a minority of persons downstream, specifically the exporters. There are reportedly half a dozen private groups in charge of the management of marketing, whether for bulk or packaged oils. These large groups emerged less than 10 years ago. For instance, in mid-2010 the group Agroliva International is mainly mentioned in references. Four years later, CHO Group stands out in our fieldwork: all actors referred to it as the majority group in the sector, whereas it was not even mentioned in 2015 by the authors of the FAO report or by Fautras in her PhD in 2017. According to one of its employees (fieldwork in 2019), 25 % of national exports of extra virgin olive oil are handled by CHO Group, the national leader in exports of packaged oils.

These large groups have integrated the whole value chain into their economic development policy. They buy and modernise oil mills and invest in irrigated production. Therefore, as in Andalusia, there is a shift to an industrial model and “an imbalance in the market to the benefit of the large purchasing groups” (Angles, 2016:71).

Let us take the example of the national leader, CHO Group. Created in 1996 by its current director, Abdelaziz Makhloufi, it is a conglomerate whose activity focuses on the olive tree and the production of oil, but it is also involved in cosmetics and fuels. Regarding the oil sector, it has 18 olive farms, 4 oil mills, multiple storage units, a certified laboratory, a bottling plant and marketing headquarters in Sfax. The group is also well established with warehouses in many countries, notably in Europe and the United States. It has also created three brands for export (Fig. 4): Terra Delyssa, filtered; Origin 846, unfiltered; and Bulk by CHO for the food industry. Origin 846 also plays on a common symbol related to Spain (the bull), which suggests that the oil is Andalusian, whereas it is produced and packaged in Sfax, as stated on the back of the bottle. The group also distributes Tunisian oils in many European supermarkets under private labels (Carrefour, Leader Price, Auchan, Intermarché) as well as other brands such as Jardin BiO by Léa Nature. For all these bottled oils, production can be conventional or organic. CHO Group told us that it is the market leader in Canada, France, eastern Europe, Germany, China and Japan with the Terra Delyssa brand.

Figure 4Logos of the three CHO Group brands. © https://group-cho.com/ (last access: 22 October 2022).

What makes CHO Group unique is its investment in packaging, which is in fact in its name (CHO stands for “Conditionnement des Huiles d'Olive”, which means olive oil packaging). While glass bottle production plants are few in number, forcing most packers to import bottles from China (FAO, 2015), CHO Group has a contract with the Tunisian glass company Sotuver. The packaging plant has a capacity of 20 000 bottles h−1. Thus, while its competitors are constrained by packaging and have to export mainly in bulk, CHO Group can export bottles with better margins. Additionally, as we were told by several CHO Group employees, they are the only ones in the oil sector who work year-round.

4.2 Moving up the value chain: processing then production

With a monopoly on the downstream part of the sector, the large groups were then able to invest at other levels, for example, by building or modernising oil mills that meet international quality standards. However it is above all in production that their investment is visible today, even if these groups buy many olives from private producers. In the topographic basin of Meknassi (Fig. 2), CHO Group purchased 1200 ha in 2014. They cultivate 530 ha of organic olives on about 70-year-old trees in semi-pluvial conditions (i.e. irrigation only starts in April in order to limit production fluctuations). They also have 650 ha under hyper-intensive farming, of which 230 ha was first planted in 2018. Yields are much higher, with 1300 plants ha−1 compared to 80–120 plants ha−1 in rainfed production. The local `Chemlali' variety does not tolerate intensive cultivation, so Andalusian cultivars such as `Arbequina' and `Arbosana' had to be planted. In order to limit diseases, plants are purchased in Tunisia. Yields are apparently much higher than in rainfed agriculture, but trees have a shorter lifespan of 20 years under hyper-intensive farming. Two large basins regulate water distribution. Irrigation is by surface or subsurface drip and is optimised through smart irrigation (water distribution is determined by soil moisture measured by sensors). As in other newly irrigated lands, these farms are the result not only of the purchase of private land, with or without plantations, but also of the rental of state land.

The colonial and post-colonial agricultural history of Tunisian olive growing has allowed the development of two dominant models: the extensive family model dedicated to self-consumption and the extensive private or public property model dedicated to export. The post-revolutionary context allowed the spread of a third model, also driven from abroad: the intensive Andalusian model recommended by the FAO and based on irrigation. It developed in a new political and economic context but was based on a favourable colonial and post-colonial agricultural development policy (see Part 2). However, the porosity between the three systems is strong and field surveys show a plurality of hybrid systems.

5.1 Irrigation to secure domestic incomes

The production model that seems to be developing in this region today is, therefore, intensification involving the transition from extensive rainfed production of 80 to 120 olive trees ha−1 to an irrigated olive grove of 200 plants ha−1 (Fig. 2). In an interview granted to the TAP Agency in 2020, Chokri Bayoudh, the CEO of the National Oil Office, announced that the objective, on a national scale, is to move from 80 000 to 100 000 t of olive oil from irrigated crops by 2025. Having started in the 1960s, intensification has mostly occurred in the last decade or so. Since the 2010s, there has even been the development (marginal for the moment) of a hyper-intensive model with more than 1000 plants ha−1.

Intensification occurs through adding new plantations by large companies or families on former rangeland and (more rarely) through uprooting old trees. For example, on one farm in Meknassi (Fig. 2), a topographic depression upstream of the Leben catchment, we were told that they were the first to use irrigation in the region in 2004/05 by buying up parcelled-out, former rangeland at a good price. The owner planted 33 000 `Arbosana' trees 4 m apart in an intensive model (Fig. 3c). The advantage of this variety is that it produces olives beginning in the second year as opposed to fifth year for the local `Chemlali' cultivar. Yet, intensification has also been observed in rainfed systems for a decade. Young olive trees are planted in two or three rows between old trees. Everything has to be irrigated, even the old trees, which now compete with the young ones. Farmers can then take advantage of this irrigation to interplant market gardens (Fig. 3b). The water used for irrigation is drawn from two types of sources: either deep aquifers with a high flow rate and good water quality, albeit very expensive and overexploited, or groundwater, which is easily accessible but largely overexploited and saline. Another article by our team focuses on collective, individual and institutional management and sustainability of water for irrigation, as well as on the bricolages and other arrangements for accessing water capital (Lavie and Ould Ahmed, 2023).

The intensification of production has also accelerated since the crisis of the 2017/18 season. Prices on the European market are set at the beginning of the season (around November–December) according to rainfall. But in February and March 2018, there were torrential rains in southern Spain, which meant that the crop forecasts for the following year changed as Spain produced much more than expected. This upset international market prices, and in Tunisia the price of oil collapsed, although the production price of olives remained stable (fieldwork in 2019). As the olives must be pressed within 48 h of harvesting, oil remained in storage in the oil mills. Nearly 60 % to 70 % of the 2018 oil was not sold, which is equivalent to 350 000 t. Oil sellers waited for better prices to sell, which may have undermined its quality (fieldwork in 2019).

This crisis in selling prices was reported by most of the actors we met. In fact, the political instability in Tunisia since the revolution, the dependence on market prices and the accentuation of droughts have pushed more and more producers to switch to intensive production in order to secure their cash flow. Indeed, even if the price of 1 kg of irrigated olive is lower than 1 kg of rainfed olive (fieldwork interviews in oil mills), trees produce olives every year and in greater quantity. Intensive production is therefore more profitable, despite the investment costs.

5.2 The resistance of the rainfed olive grove

There are a few obstacles to implementing the industrial model locally called Andalusian. The first is the age of the trees: many are over 70 years old, planted under the protectorate. A clear-cut can revive an old tree for about 20 years of additional production, even if it is lower in terms of yield. Afterwards, trees produce little. But uprooting and planting young `Chemlali' trees that will be productive in half a decade is not optimal in the short term for a family that has little income other than from olive growing or for a senior farmer without a successor to take over the farm. A second obstacle is the lack of a cooperative model. Modernisation generally involves irrigation (Burt, 2013). The major difference between the Andalusian model and its application in Tunisia is that “the Andalusian system is organised around a strong social, economic and geographical cohesion, centred on small farms, a dominant collective spirit (cooperatives in particular)” (Angles, 2016:71; see also Ortiz-Miranda et al., 2010). This is also the case in France, for example, where cooperatives and associations of irrigators are major stakeholders in the sector (Agarwal and Dorin, 2019). “Thus, in an attempt to better valorise and sell their production, Andalusian actors always advocate strengthening cooperatives with more crushing capacity and associating cooperatives within cooperative groupings to better ensure marketing” (Agarwal and Dorin, 2019:71). This is not the case with the Tunisian olive oil system. Between 1960 and 1968, in the newly independent Tunisia, Habib Bourguiba adopted an agricultural cooperative system, but it failed. Various authors have pointed to mediocre results, land deprivation and of course the farmers' discontent (Makhlouf, 1971; Boulet, 1971; Elloumi, 1990, 2013; Fautras, 2021; Rebaï, 2022). Today there are service cooperatives to buy inputs and sell certain products, but there is no “social cohesion” or “collective spirit” (interviews of farmer and agricultural engineer, fieldwork in 2019). The FAO (2015) report underlines the need to support the creation of cooperatives and recommends a new, more collective organisation of olive production.

There are therefore two models of olive production, each linked to a different strategy: one seeks to maintain existing farms and to raise income, while the other races to increase market share (Ould Ahmed et al., 2019). The colonial model predominates in terms of production. However, the restructuring of production towards intensification is only the last step in a process already underway downstream of the sector. Indeed, the processing and marketing of oil are already oriented towards quality and export.

5.3 Other opportunities in processing

Although the sector seems less vulnerable to climatic hazards in the short term, olives produced under intensification and irrigation contain more water and therefore produce an oil of lower taste quality, even if the oil meets international health standards. Irrigated farmers sell more olives to mills every year but at lower prices. For oil mills, rainfed production is more interesting in terms of taste, but it is more precarious, which makes irrigated production more interesting in terms of income (fieldwork in 2019). If the country is willing to implement the FAO report elements (FAO, 2015), Tunisia still has an effort to make in terms of modernising traditional oil mills that do not meet international quality standards. However modernisation could lead to increased exports. But, at the time of our field study in 2019, the processing sector (crushing) was not yet at the required level and was therefore an obstacle to the application of the Andalusian model in its entirety.

5.4 Other opportunities in marketing

The shift in exporting from a public to a private monopoly, starting in 1994 and followed by the revolution, forced the sector to adapt. Today some groups manage the entire sector. We have observed in the field that the FAO's recommendations concerning exports have been widely followed. Thus, the traditional European market has been consolidated, and even the Tunisian state has attempted to increase the export quota to the European Union. Emerging markets have been explored, and dynamic changes are underway, particularly as regards Russia, China, the Middle East and the North Africa zone. CHO Group has created CHO USA, which has a majority stake in Canada; is trying to establish itself in China and Russia; and is interested in expanding to Morocco (fieldwork-2019).

The recommendation to favour domestic consumption, although repeated in the FAO (2015) report, did not come up in our interviews. Only the Domaine Public de Châal (state land) told us that they bottle a range of organic qualities for the Tunisian market under the Diwen brand.

All the actors also explained that the conversion to higher-quality products that are bottled and certified as organic is an interesting way to increase margins. Most rainfed agriculture uses very few agricultural inputs. Conversion to organic production is therefore accessible to a large number of producers, except for the cost of certification. Intensification, however, runs counter to this dynamic. Moreover, Tunisia produces few glass bottles. The export of olive oil in bulk to southern Europe will probably continue.

From the three hypotheses presented in the Introduction, it appears (1) that the transition in the post-revolutionary context is based on policies and modes of production that take roots from colonial, post-colonial and recent history (Part 2); (2) that some exporters are involved at many levels of the sector, shifting from a public monopoly to a private one (Part 4); and (3) that it would be an exaggeration to see Tunisia as a new Andalusia (Part 5). Rainfed production remains the majority production mode, and there are still many traditional oil mills that process oil for families and for national production. The intensive and hyper-intensive models are therefore developing in parallel with another model based on a qualitative system of organic oils, which focuses on packaged marketing.

In a paradoxical context that involves producing more for export while depending on climate change, our research has enabled us to identify the presence of a dominant rainfed model and an intensive model, with new standards, supported by public authorities. We have also highlighted the plurality of systems in the field, with a multiplication of hybrids of family and entrepreneurial systems, more or less irrigated farms, and a plurality of activities and modes of marketing. Now that the genesis of the systems has been demonstrated, it remains to analyse their sustainability (Lavie and Ould Ahmed, submitted).

No data sets were used in this article.

All the authors took part in the field interviews and collective discussions that helped to identify the issues. EL, POA and PC participated in the acquisition of funds and conceptualised and structured the article. EL produced the maps and wrote the article, from the first draft to the final version. POA carried out an in-depth critical reading of each version. All the authors revised the versions submitted.

The contact author has declared that none of the authors has any competing interests.

Publisher’s note: Copernicus Publications remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The authors would like to thank the anonymous reviewers for their very pertinent comments, which helped to improve the article.

This research has been supported by the Laboratoire d'Excellence Dynamiques Territoriales et Spatiales (SAR-DYN grant).

This paper was edited by Jevgeniy Bluwstein and reviewed by three anonymous referees.

Abaab, A. and Elloumi, M.: L'agriculture tunisienne. De l'ajustement au défi de la mondialisation, edited by: Elloumi, M., in: Politiques agricoles et stratégies paysannes au Maghreb et en Méditerranée occidentale, Tunis, Alif-IRMC, 114–145, 1996.

Agarwal, B. and Dorin, B.: Group farming in France: Why do some regions have more cooperative ventures than others?, Environ. Plann. A, 51, 781–804, 2019.

Angles, S.: Oléiculture, systèmes oléicoles et territoires méditerranéens : de la filière au paysage, Habilitation Thesis, University Paris 13-North, https://theses.hal.science/tel-01536386/document (last access: 29 August 2023), 2016.

Bédoucha, G.: Libertés coutumières et pouvoir central, L'enjeu du droit de l'eau dans les oasis du Maghreb, Étud. Rurales, 155–156, 117–141, 2000.

Boulet, D.: Étude économique des coopératives agricoles de production en Tunisie, Options méditerranéennes, 6, 97–103, 1971.

Burt, C. M.: The irrigation sector shift from construction to modernization. What is required for success?, Irrig. Drain., 62, 247–254, 2013.

Canesse, A. A.: Gestion des ressources naturelles et système institutionnel de gouvernance en Tunisie, Maghreb-Machrek, 202, 49–64, 2009.

Chaker, S.: Impacts sociaux de l'ajustement structurel : cas de la Tunisie, Nouvelles pratiques sociales, 10, 151–162, 1997.

Chaouche, K., Neppel, L., Dieulin, C., Pujol, N., Ladouche, B., Martin, E., Salas D., and Caballero, Y.: Analyses of precipitation, temperature and evapotranspiration in a French Mediterranean region in the context of climate change, C. R. Geosc., 342, 234–243, 2010.

Cohen, M., Ronchail, J., Alonso-Roldán, M., Morcel, C., Angles, S., Araque-Jimenez, E., and Labat, D.: Adaptability of Mediterranean Agricultural Systems to Climate Change. The Example of the Sierra Mágina Olive-Growing Region (Andalusia, Spain). Part I: Past and Present, Weather Clim. Soc., 6, 380–398, 2014.

Daoud, A.: Tensions, conflits pour l'usage de l'eau et modes de régulation dans les périmètres irrigués des Hautes steppes orientales tunisiennes, edited by: Cherif A. and Hénia L., in: Climat, société et dynamique des paysages ruraux en Tunisie, Tunis, universities of Tunis and Manouba, 222–258, ISBN 9789973069184, 2010.

Daoud, A. and Dahech, S.: Evidence of climate change and its effects in the Mediterranean, Méditerranée, 128, 7 pp., https://doi.org/10.4000/mediterranee.8519, 2017.

Davis, D.: Resurrecting the granary of Rome: environmental history and French colonial expansion in North Africa, 58, Ohio University Press, ISBN 0821417517, 2007.

Elloumi, M.: Fonctionnement des unités coopératives de production dans la région de Mateur, Revue tunisienne de géographie, 18, 95–147, 1990.

Elloumi, M.: Les terres domaniales en Tunisie, Histoire d'une appropriation par les pouvoirs publics, Étud. Rurales, 192, 43–60, https://doi.org/10.4000/etudesrurales.9888 2013.

Fakhfakh, M.: Sfax et sa région: étude de géographie humaine et économique, PhD dissertation, University Paris 7, 1975.

Fautras, M.: La terre entre racines, épargnes et speculations, Appropriations foncières et recompositions de l'espace rural à Regueb (Tunisie), PhD dissertation, University Paris Ouest Nanterre La Défense, https://hal.science/tel-01625597 (last access: 29 August 2023), 2017.

Fautras, M.: Paysans dans la Révolution, Un défi tunisien, Paris, Tunis, IRD and IRMC, 481 pp., ISBN 9782811128159, 2021.

Food and Agriculture Organization: Tunisie. Analyse de la filière oléicole, FAO-report, 186, https://www.fao.org/3/i4104f/i4104f.pdf (last access: 29 August 2023), 2015.

Frini, M.: Résistances de l'huile d'olive dans la Tunisie colonial, L'Année du Maghreb, 14, 133–146, 2016.

Jouili, M., Kahouli, I., and Elloumi, M.: Appropriation des ressources hydrauliques et processus d'exclusion dans la région de Sidi Bouzid (Tunisie centrale), Étud. Rurales, 2, 117–134, 2013.

Giorgi, F.: Climate change hot spots, Geophys. Res. Lett., 33, L08707, https://doi.org/10.1029/2006GL025734, 2006.

Giorgi, F. and Lionello, P.: Climate change projections for the Mediterranean Region, Global Planet. Change, 63, 90–104, 2008.

Jacobeit, J., Hertig, E. Seubert, S., and Romberg, K.: Statistical downscaling for climate change projections in the Mediterranean region: methods and results, Reg. Environ. Change, 14, 1891–1906, 2014.

Laitman, L.: Le marché et la production de l'huile d'olive en Tunisie, Ann. Geog., 62, 271–286, 1953.

Lavie, E. and Ould Ahmed, P.: Mutations dans la production oléicole tunisienne : irriguer pour durer?, Suds, submitted, 2023.

Makhlouf, E.: Les coopératives agricoles en Tunisie : structures et difficultés, Revue Tunisienne de Sciences Sociales, 8, 79–114, 1971.

Ortiz-Miranda, D., Moreno-Pérez, O. M., and Moragues-Faus, A. M.: Innovative strategies of agricultural cooperatives in the framework of the new rural development paradigms: the case of the Region of Valencia (Spain), Environ. Plann. A, 42, 661–677, 2010.

Ould Ahmed, P., Cadène, P., Lavie, E., and Chiab, I.: Globalizing olive oil industry, the Tunisian strategy. Kuala Lumpur, Embedded Scales of Agriculture Production Systems, SMEs, and Global Value Chains: Is it a Feature Unique to Agribusiness?, 11 and 12 December, 2019.

Poncet, J.: La colonisation et l'agriculture européenne en Tunisie depuis 1881, Étude de géographie historique et économique, PhD dissertation, University of Paris, https://gallica.bnf.fr/ark:/12148/bpt6k3365842m (last access: 29 August 2023), 1961.

Raymond, F., Ullmann, A., and Camberlin, P.: Très longs épisodes secs hivernaux dans le bassin méditerranéen : variabilité spatio-temporelle et impact sur la production céréalière en Espagne, Cybergeo: Eur. J. Geog, 858, https://doi.org/10.4000/cybergeo.29156, 2018.

Rebaï, N.: Les territoires ruraux de montagne en Tunisie, entre marginalisation et perspectives de transition, Éléments d'analyse depuis le Jbel Bargou, Cybergeo: Eur. J. Geog., https://doi.org/10.4000/cybergeo.38728 2022.

Sethom, H.: Les tentatives de remodelage de l'espace tunisien depuis l'indépendance, Méditerranée, 35, 119–125, 1979.

Tuel, A. and Eltahir, E. A. B.: Why is the Mediterranean a climate change hot spot?, J. Climate, 33, 5829–5843, 2020.

Vicente-Serrano, S. M., Lopez-Moreno, J.-I., Beguería, S., Lorenzo-Lacruz, J., Sanchez-Lorenzo, A., García-Ruiz, J. M., Azorin-Molina, C., Morán-Tejeda, E., Revuelto, J., Trigo, R., Coelho, F., and Espejo, F.: Evidence of increasing drought severity caused by temperature rise in southern Europe, Environ. Res. Lett., 9, 044001, https://doi.org/10.1088/1748-9326/9/4/044001, 2014.

Yazidi, B.: Le commerce de l'huile en Tunisie à l'époque colonial, Proceedings of the Colloquium : L'olivier en Méditerranée, entre Histoire et patrimoine, Sousse, 6–10 February 2007, ISBN 978-9973-37-682-4, 2011.

Zaied, Y. B. and Zouabi, O.: Impacts of climate change on Tunisian olive oil output, Climatic Change, 139, 535–549, 2016.

All translations are from the authors.

- Abstract

- Introduction

- From colonial to Andalusian models: inheritance and imported models

- Research approach and context

- A sector increasingly managed by exporters

- The implementation of the FAO report in production: what are the effects and limits on the olive oil sector?

- Conclusions

- Data availability

- Author contributions

- Competing interests

- Disclaimer

- Acknowledgements

- Financial support

- Review statement

- References

- Abstract

- Introduction

- From colonial to Andalusian models: inheritance and imported models

- Research approach and context

- A sector increasingly managed by exporters

- The implementation of the FAO report in production: what are the effects and limits on the olive oil sector?

- Conclusions

- Data availability

- Author contributions

- Competing interests

- Disclaimer

- Acknowledgements

- Financial support

- Review statement

- References